- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Trading Strategies, Psychology

- Why you need to know about Expected Value

- Home

- News & Analysis

- Trading Strategies, Psychology

- Why you need to know about Expected Value

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisMany traders early on in their trading journey may jump into trading without knowing if their system or edge can be profitable. The most important metric that a trader should measure their system on is by using expected value. This essentially wors out the average return that the system will return for every trade that it makes, considering both winning trades and losing trades. The formular for the expected value is written below.

Expected Value = (Probability of winning trade X Average Winning Trade Value) – (Probability of a Losing trade X Average Loss)

For example, Trader A

– Wins 40% of their trades

– Loses 60% of their trades

– Average win = $20

– Average Loss = $10

Therefore, Expected Value = (0.4×20) – (0.6×10)

= $2

This means over the long run the system will return $2.00 per trade made.

This relationship describes any trading strategy or edge’s average performance per trade. Therefore, by determining the expected value a trader can see how effective their edge will be excluding slippage and transaction costs in the long term.

Risk and Return

The relationship also shows that a strategy does not need to necessarily win every single trade to be profitable. The rule of risk and reward is that they are inversely correlated. This means that the more a trader is willing to risk, whether it be size or distance to a stop loss the higher potential reward. Alternatively, the less risk a trader takes the lower potential reward. It doesn’t matter which type of trader you are often different personality types will gravitate to either more frequent winning and smaller winnings or larger winnings, but a smaller number of wins.

In fact, a trader may only need to be profitable on 20% of their trades if they can ensure that their average winning trades are more profitable by a factor of 5:1. A strategy that wins more frequently may only need a smaller average win vs its average loss. When testing a system, it is important that there is sufficient data to ensure the inputs for the above formula is accurate. This means using data from various time periods and potentially across a range of markets to measure the Expected Value of the system.

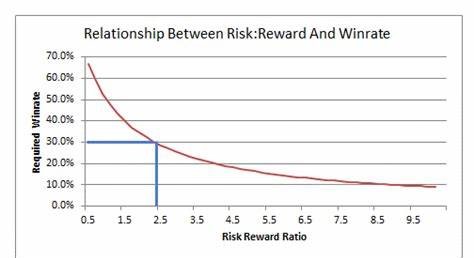

See below for the required a=Average Winning trade/Average Loss trade per Average win rate for a breakeven trading system.

Ultimately it is vital that when assessing the performance of a trading strategy or edge to be able to measure the profitability of the system. The best way to do this is by using expected value. Profitable trading strategies can be made with either a high win rate and low average W/L ratio or a low winning strategy with a high W/L ratio.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Medtronic posts mixed results

Medtronic posts mixed results Medtronic Plc (NYSE: MDT) reported latest financial results for its second quarter of fiscal year 2023, which ended October 28, 2022 on Tuesday. The medical technology company posted mixed results for the quarter. Revenue reported at $7.585 billion (down 3% year-over-year) vs. $7.698 billion expected. Earni...

November 23, 2022Read More >Previous Article

Zoom tops Q3 estimates

Zoom Video Communications Inc. (NASDAQ: ZM) reported third quarter financial results after the market close in the US on Monday. The US communicati...

November 22, 2022Read More >