- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

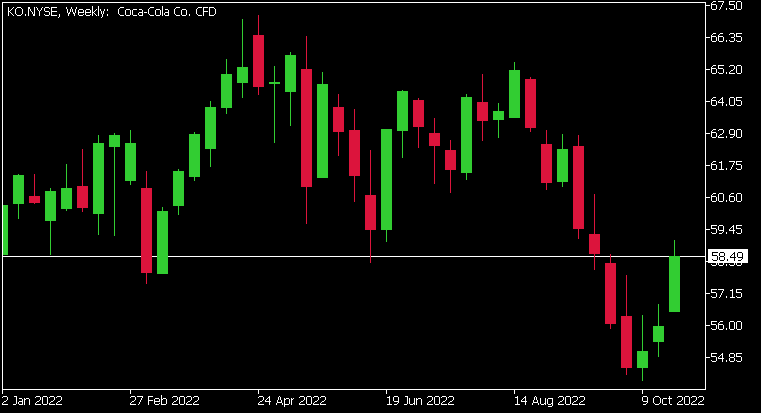

- Coca-Cola tops Wall Street Q3 estimates

- 1 month: +3.39%

- 3 months: -7.78%

- Year-to-date: -1.55%

- 1 year: +7.01%

- Deutsche Bank: $59

- Wedbush: $63

- Morgan Stanley: $68

- Credit Suisse: $64

- Wells Fargo: $66

- HSBC: $76

- UBS: $72

- JP Morgan: $70

News & AnalysisCoca-Cola tops Wall Street Q3 estimates

The Coca-Cola Company (NYSE:KO) reported Q3 financial results before the market open on Tuesday.

The US beverage company posted solid results for the quarter, beating Wall Street analyst estimates for both revenue and earnings per share (EPS).

Revenue reported at $11.063 billion (up by 10% year-over-year) vs. $10.52 billion expected.

EPS at $0.69 per share (up by 7% year-over-year) vs. $0.637 per share estimate.

”Our strong capabilities and consumer insights continue to help us win in the marketplace,” Coca-Cola CEO, James Quincey said in a press release.

”Our business is resilient amidst a dynamic operating and macroeconomic environment. We are investing in our strong portfolio of brands, which is a cornerstone of our ability to deliver long-term value for our stakeholders,” Quincey added.

Shares of Coca-Cola were up by around 1% on Tuesday, trading at $58.49 a share.

Stock performance

Coca-Cola price targets

Coca-Cola is the 30th largest company in the world with a market cap of $251.88 billion.

You can trade The Coca-Cola Company (NYSE:KO) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD.

Sources: The Coca-Cola Company, TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Short term break out on the EURUSD

The EURUSD is showing some signs of a potential short term break out on the daily and 4-hour time price charts. This is largely a technical breakout, although it is also supported by a shift in sentiment towards growth assets and away from the USD in the last week. Technical Analysis The daily cart show...

October 26, 2022Read More >Previous Article

Pound gearing up for a reversal?

The UK has had to deal with recessionary fears, sky high energy prices, a cost-of-living crisis, and a breakdown in political leadership. This has cau...

October 25, 2022Read More >