- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Gold Testing Major Support Level

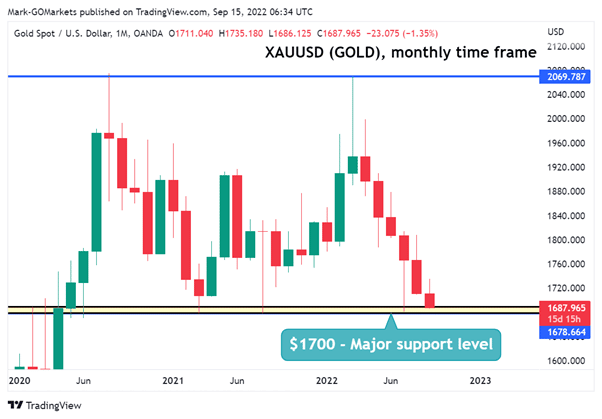

News & AnalysisFor the last 2 years, Gold has been bouncing in a range between $1700 and $2070 and is currently testing the major support level around $1700 as seen below.

The price has used the yellow highlighted as an area for support zone and a rejection zone. Over the last 2 years clear rejections have occurred every time the price has reached around $1700’s. These candlestick rejections indicate a high probability of something similar potentially happening.

We find further confluence of this analysis by looking at the weekly time frame, where Gold has broken above the trend line, and has now come back to retest it. This can often result in a bounce off the trendline, creating the start of a new uptrend.

If Gold continues to remain above the trendline and can hold the monthly support, it may indicate that it is in the early stages of a potential reversal. This may lead to another move toward the $2000’s.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

AutoZone latest results have arrived

AutoZone Inc. (AZO) reported its fourth quarter financial results for the period ending August 27, 2022 on Monday. The largest US retailer of aftermarket automotive parts reported revenue of $5.348 billion (up by 8.9% from the same period last year) vs. $5.164 billion expected. The company reported earnings per share of $40.51 for the quarter...

September 20, 2022Read More >Previous Article

Adobe announces latest results and Figma acquisition

Adobe Inc. (ADBE) announced its financial results for the third quarter of the fiscal year 2022 before the opening bell in the US on Thursday. The ...

September 16, 2022Read More >