- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- USDJPY ready to bounce or retrace further.

News & AnalysisUSDJPY ready to bounce or retrace further.

The USDJPY has been recently provided great buying opportunities for traders. However, in recent days it has posted its largest drop since beginning the current upward at the beginning of January 2021. The question remains, is this just a standard retracement or is it a symbol of a much bigger reversal.

In the last few months, the USD has risen sharply as the market has responded to inflation fears and geopolitical events. With inflation levels at record levels across much of the developed world many Central Banks have shifted to a hawkish stance regarding their monetary policy with the USA being a prime example of this. On the contrary, the Central Bank of Japan has remained dovish almost acting as a lone solider compared to other countries in this regard. Despite this, as bond yields have begun to settle down and the market has begun to price in recession fears and inflation, the YEN has become attractive again.

Technical Analysis

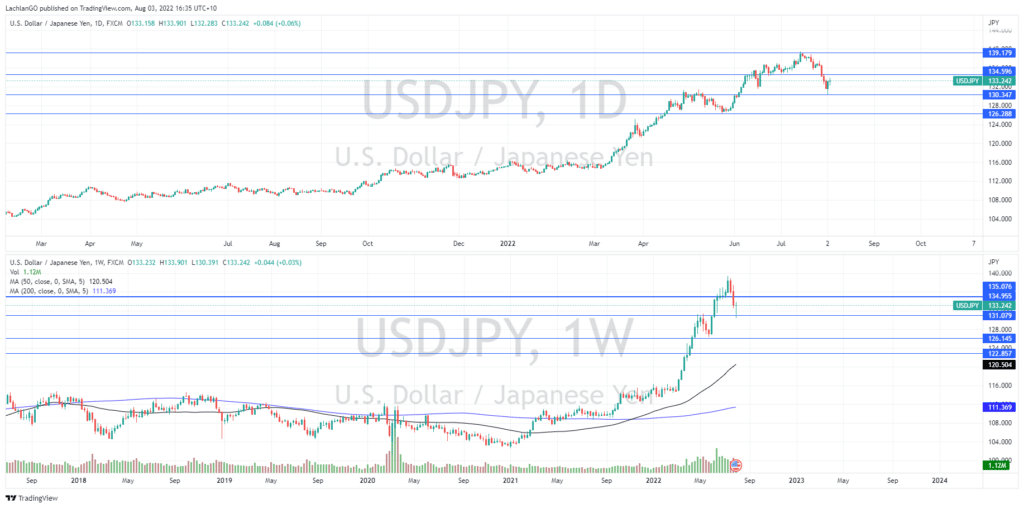

Looking at the technical elements of the chart, the price is down from the multi decade highs of 139 that it reached in the middle of July. Importantly the price has also dropped below the most recent support level. In addition, the price has also breached the 50-day moving average. The question that remains is whether this is a simple retracement or the signs of a reversal occurring.

There are two characteristics of this price action that support the potential bounce back to the upside for this currency pair. Firstly, on the daily, chart, although the price did break through the initial first level of support it is currently holding the next stronger level down at 131/132. In addition, looking at the weekly chart, the price is showing a relatively strong bounce off the same 131/132 zone. This multi timeframe analysis, further supports the continuation of the upward trend of the pair. The midterm buy target may be a retest of the 140 level.

There is a large risk with this trade. If the ‘Top’ is indeed ‘in’ and the pair does start to falter, then there is risk of massive selling. This is because the pair is already so overextended to the buy side. In addition, a rush to close Yen short positions may further accelerate the move back downward. If this does occur and the 130 level breaks it may see the price fall to the 125 level.

The short-term future of the pair will still likely be determined by short term economic news and activity within both Japan and the USA.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Moderna Q2 results announced – the stock gets a boost

Moderna Inc. (MRNA) reported its Q2 financial results before the opening bell on Wall Street on Wednesday. The American biotechnology company posted results that beat expectations, sending the stock higher at the open. The company reported revenue of $4.749 billion for the quarter vs. $4.097 billion expected. Earnings per share reported at...

August 4, 2022Read More >Previous Article

PayPal Q2 earnings results are here

PayPal Holding Inc. (PYPL) announced its latest financial results after the closing bell in the US on Tuesday. The US financial technology company ...

August 3, 2022Read More >