- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- US equities finish lower in volatile session after FOMC hawkish surprise

- Home

- News & Analysis

- Forex

- US equities finish lower in volatile session after FOMC hawkish surprise

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS equities finish lower in volatile session after FOMC hawkish surprise

15 December 2022 By Lachlan MeakinUS equities went into their cash session on a high after a drop in import and export price inflation fuelled hopes that the peak is in and of a more dovish Fed. These hopes were dashed by Jerome Powell near the end of the session, delivering a 50bp hike to the US target rate and giving what was seen as a hawkish accompanying statement and presser.

The broad S&P 500 started the session above the important 200-day SMA level, which has been a level of stiff resistance, and finished below, down 24.33 points or -0.61%.

While the 50bp hike was almost fully priced in, and a welcome relief from the recent burst of 75bp hikes, the hawkish presser by Chair Powell where he dashed hopes for any imminent Fed pivot saw risk assets tumble and the US dollar rally sharply.

Interestingly the USD rally didn’t last long and retraced not long after showing that rates markets and by extension FX markets aren’t fully buying the Fed’s hawkish expectations with Major FX pairs continuing their grind higher against the Greenback. The GBP continued it’s stellar run, now having rallied 20% from it’s October Gilt chaos inspired lows and breaking through the resistance level of 1.2330, levels not seen since June.

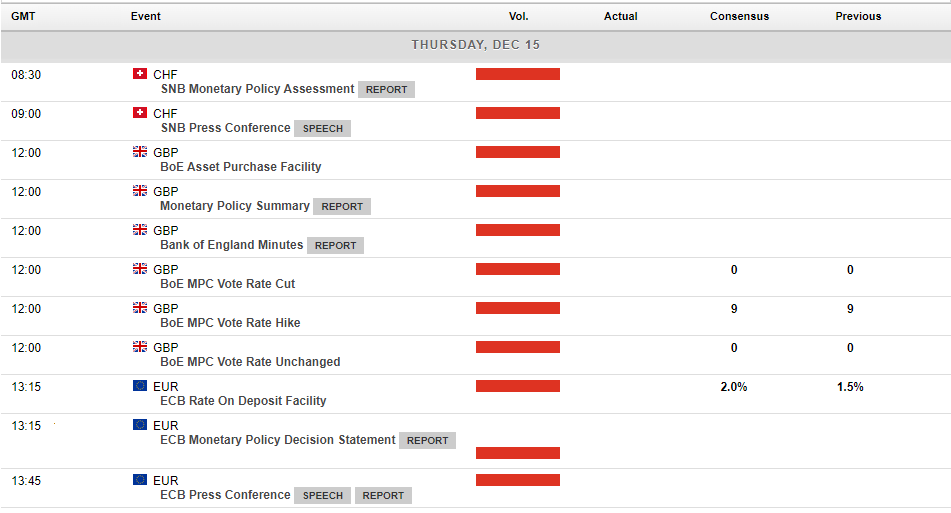

All eyes will now turn to a very busy session in Central Bank action with the Swiss National Bank, Bank of England and European Central bank all expected to hike official rates by 50bp on Thursday, again you would expect the actual hike reaction to be subdued, it will be accompanying statements and pressers where clues of future actions will drive volatility, trade accordingly.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Yuan sees increasing strength as Covid 19 restrictions ease

Yuan sees increasing strength as Covid 19 restrictions ease The USDCNH is an important currency pair not just in terms of pure trading but also in terms of gauging overall market sentiment. The pair is also reflective of much of the macroeconomic pressures effecting the global economy at the moment. This includes but is not limited to, recessionar...

December 15, 2022Read More >Previous Article

Gold rises to 6 months high as USD weakens

Gold rises to 6 months high as USD weakens The price of gold has risen as softer inflationary figures pushed the USD lower. The month/mon...

December 14, 2022Read More >