- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Opportunities await trading the JPY

News & AnalysisWith central banks aggressively hiking interest rates to combat inflation, one specific country stands alone in maintaining a dovish stance. The country is Japan, and the consequence of the Central Bank of Japan’s ultra-dovish policy has been a massive weakening of its currency. Against almost all other currencies the JPY has been depreciating aggressively. Specifically, the USD/JPY and the NZD/JPY are shaping as potentially trading opportunities. Both trading opportunities are largely based on a technical breakout as opposed to a pure fundamental breakout.

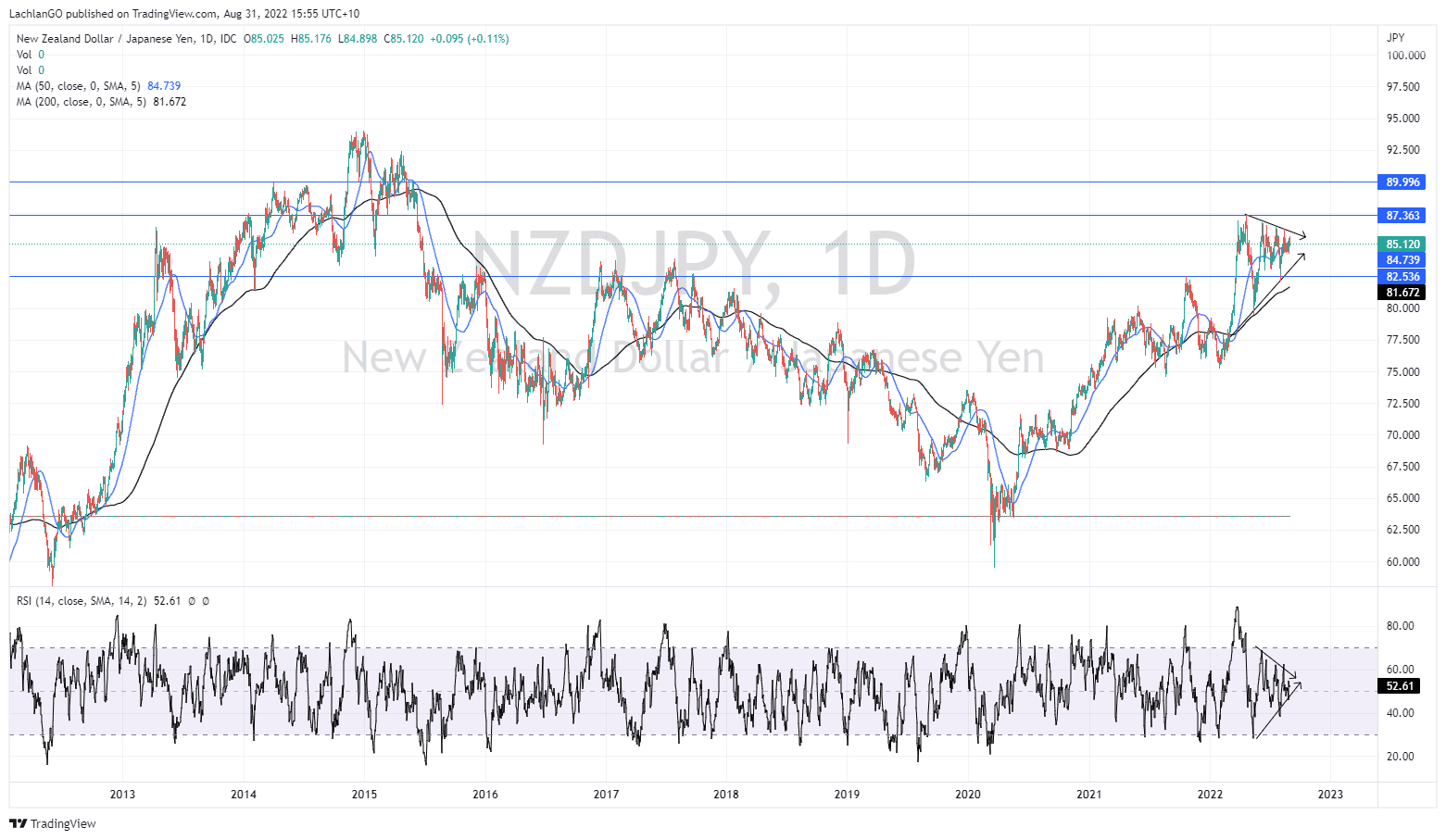

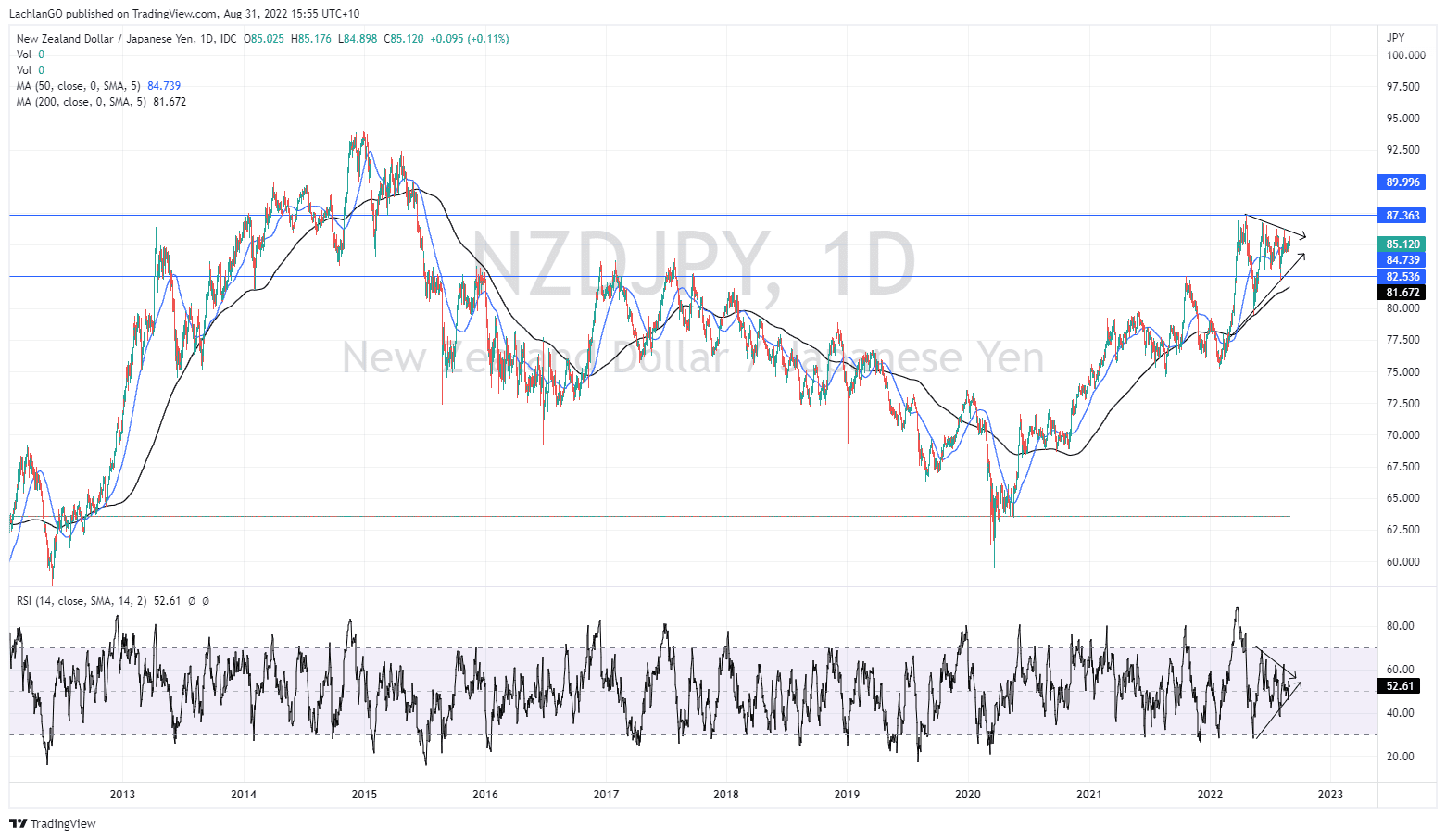

NZD/JPY

This currency pair is forming into a symmetrical triangle pattern. Importantly the price has been contracting and the range getting smaller. This shows that the price is reaching an equilibrium point between buyers and sellers. However, at some point and the price will not be able to contract further and will have to break out either to the upside or the downside. The general rule of a symmetrical triangle is to wait until the price breaks before taking a position because the price has not indicated if it will break upward or downward. In addition, the RSI indicates a similar pattern showing consolidation in the same type of triangle. Therefore, a break of this RSI triangle may correlate and support a break out on the actual price.

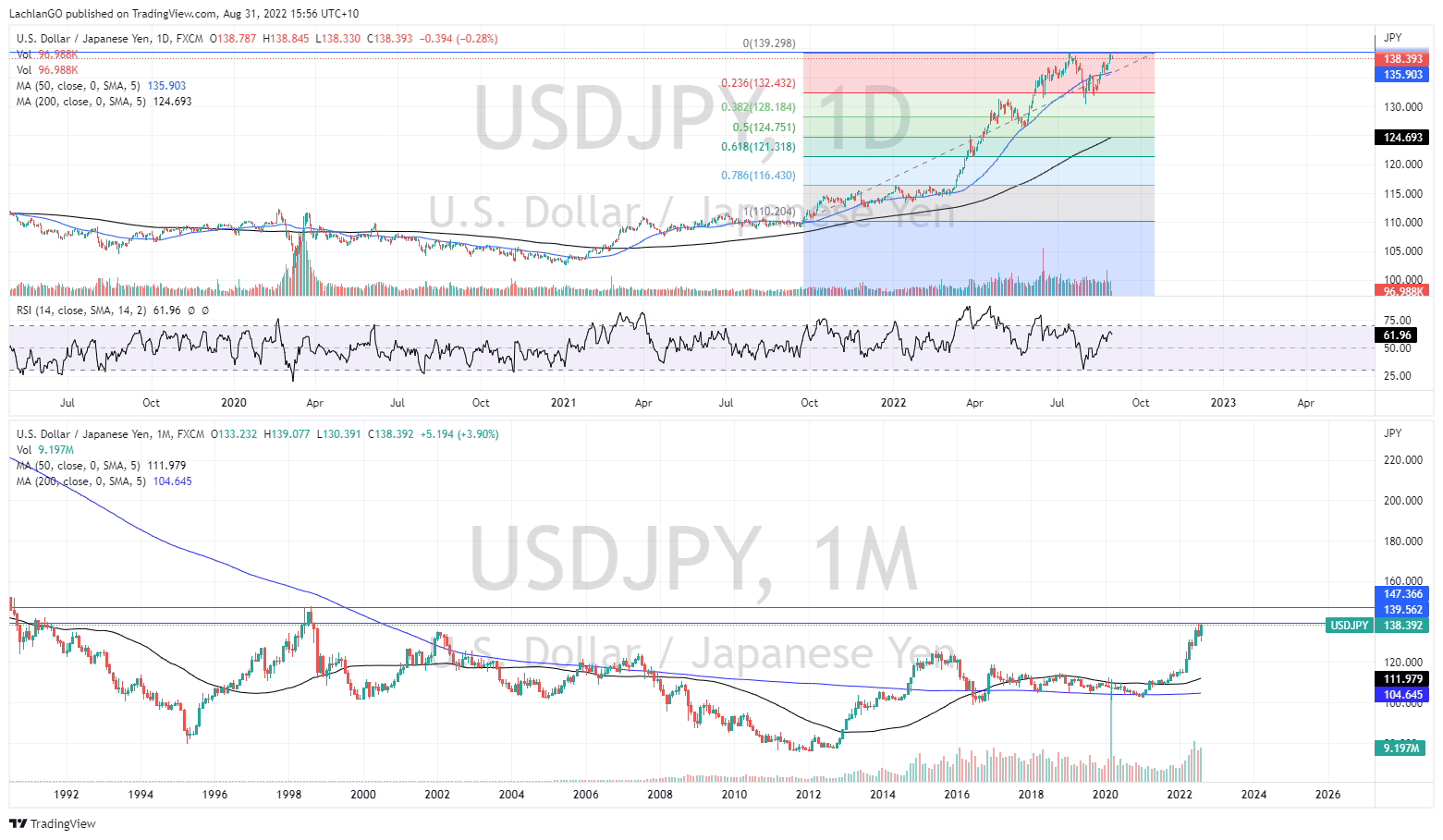

USD/JPY

This pair has seen an even more extreme move upward. After pulling back to the recent support at the 23.6% Fibonacci retracement level, the price has risen again and is looking to test the highs at 139.5 JPY. In order to find a new target the chat needs to be zoomed out to the monthly in order to see the next resistance point which is at 145JPY. This would also take the price to almost 25 year highs. With more economic data to come out of the USA later this week.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Will gold hold its support or will the USD push it below $1660

Will gold hold its support or will the USD push it below $1660 Gold has dumped again after recession fears and a strong US dollar continue to grip the market. With Gold priced in US dollars it means that when the USD is strong the price of gold and other commodities is reduced. In recent days, following on from Jackson Hole the price has slum...

September 1, 2022Read More >Previous Article

What is Fundamental Analysis, News and Fundamental Trading?

Have you ever heard the saying, “70% of trading is in the head”? This is because the markets are mostly moved with sentiment, a good barometer...

August 31, 2022Read More >