- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX wrap – GBP volatile on BoE surprise, JPY and CHF under pressure, USD follows yields up

- Home

- News & Analysis

- Forex

- FX wrap – GBP volatile on BoE surprise, JPY and CHF under pressure, USD follows yields up

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX wrap – GBP volatile on BoE surprise, JPY and CHF under pressure, USD follows yields up

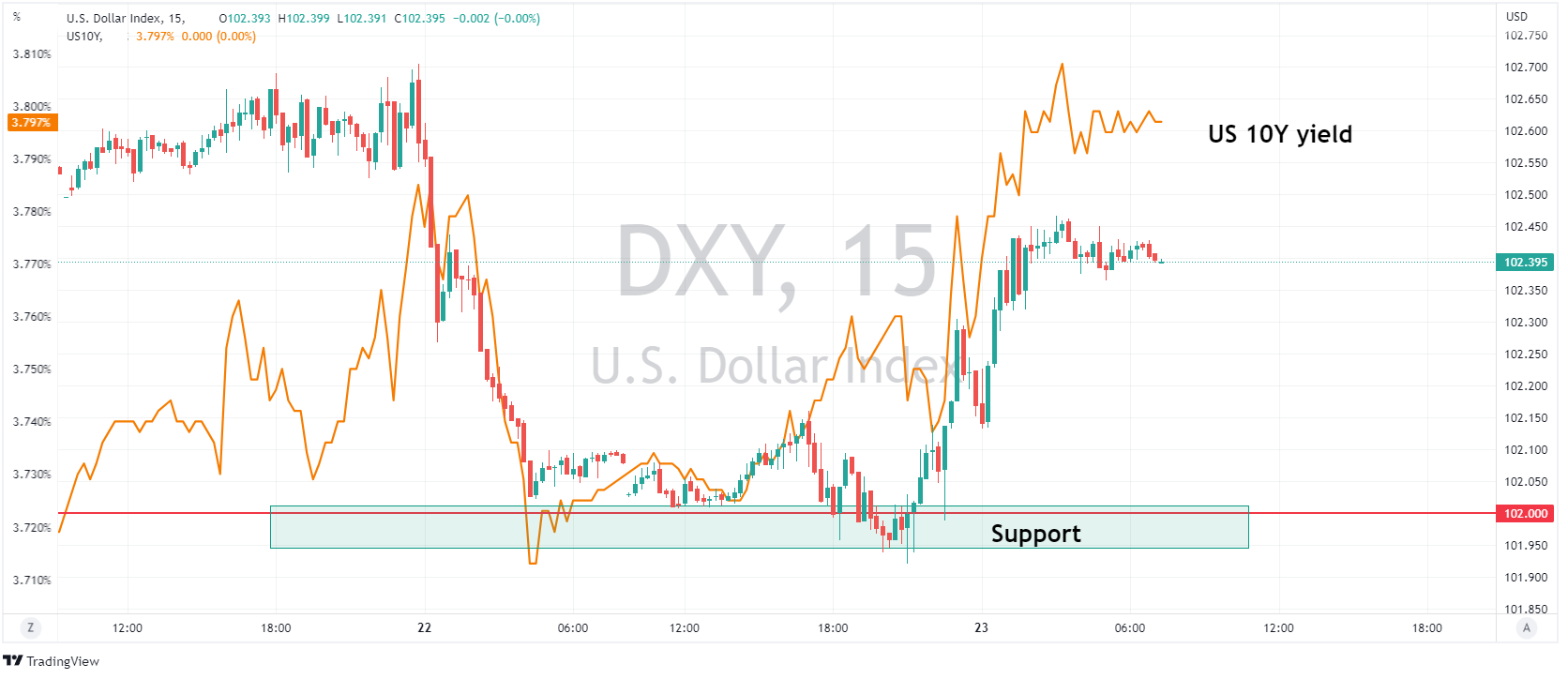

23 June 2023 By Lachlan MeakinUSD was firmer on Thursday, largely due to a rally in treasury yields with the DXY tracking the 10 year yield higher to a peak of 102.470 after bouncing off the psychological 102 support level. US data was mixed with Unemployment claims and current account figures coming in worse than expected, but this was offset by a beat in Existing home sales. There was a selection of Fed speakers, with the Chair Powell headlining. Little new was revealed with Chair Powell re-iterating the FOMC broadly feels it will be appropriate to raise rates again this year which surprised no-one.

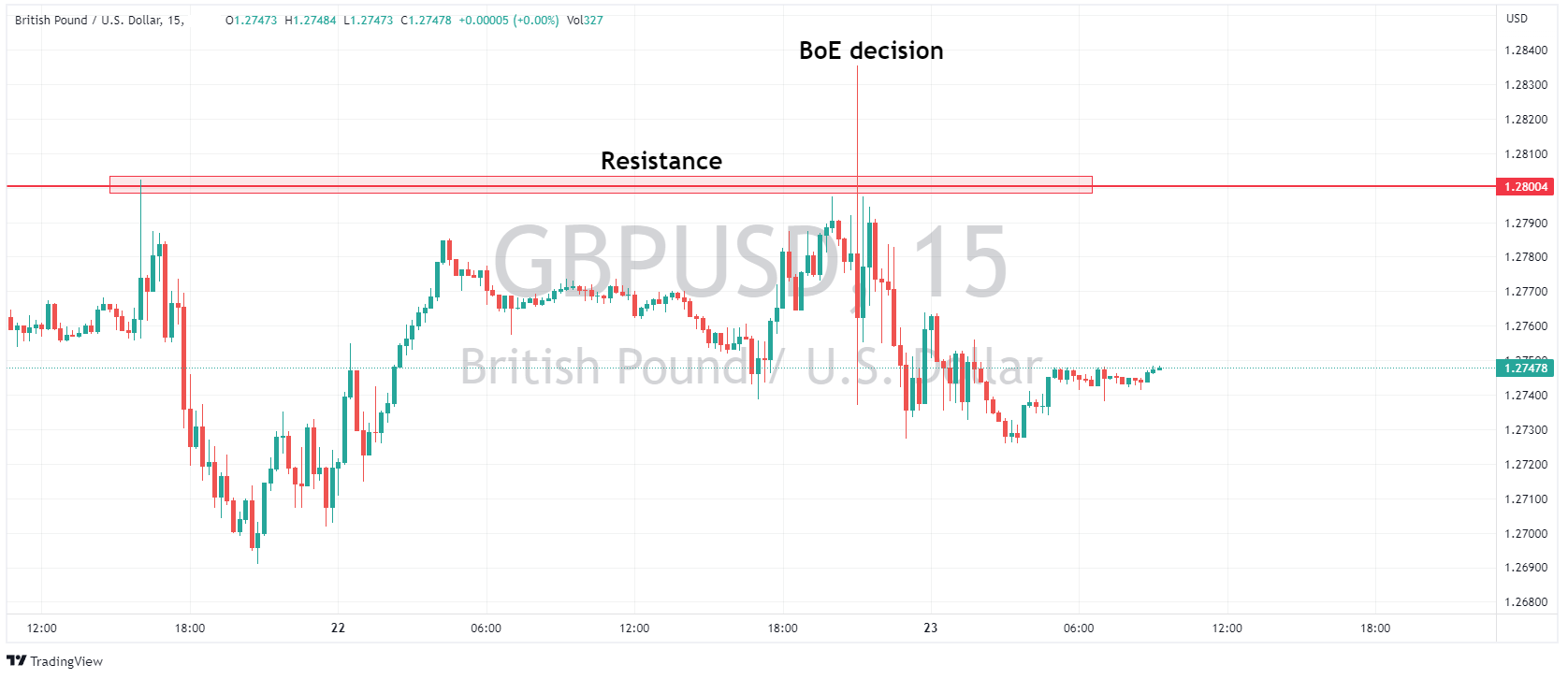

GBP was volatile after the BoE somewhat surprised markets with a larger than expected 50bp hike, going into the meeting a 25bp was the favoured outcome by economists, but a 50bp was partially priced in so not a totally unexpected move from the BoE. The bank also maintained guidance further tightening would be required if there was more evidence of persistent inflation. Post decision GBPUSD hit a high of 1.2838 in a knee jerk reaction before reversing the move and eventually hitting lows of 1.2728 in similar price action we saw after Wednesdays hotter than expected CPI figure. GBP price action is indicating the market feels further hawkish re-pricing of BoE action is limited, with fears that the current projected path will lead to recession in the UK weighing on the Pound and Cable will struggle to breach the major resistance at 1.28.

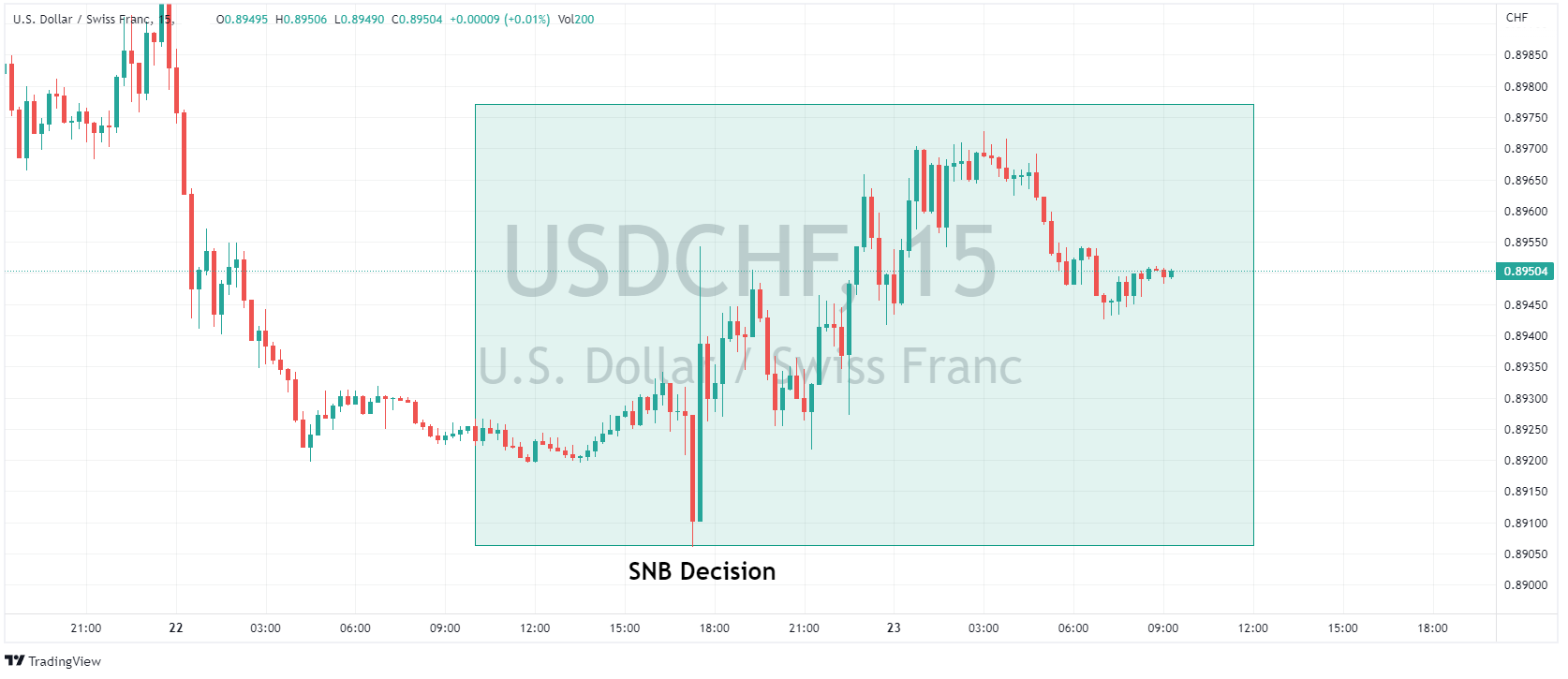

CHF was lower vs the USD after seeing weakness in the aftermath of the SNB rate decision where the SNB hiked by 25bps disappointing some market participants who were looking for a 50bp move. The SNB did note however that additional rate hikes will be necessary. After an initial spike lower to test the 0.8900 support zone, USDCH reversed course, hitting a high of 0.8973 before finding some selling.

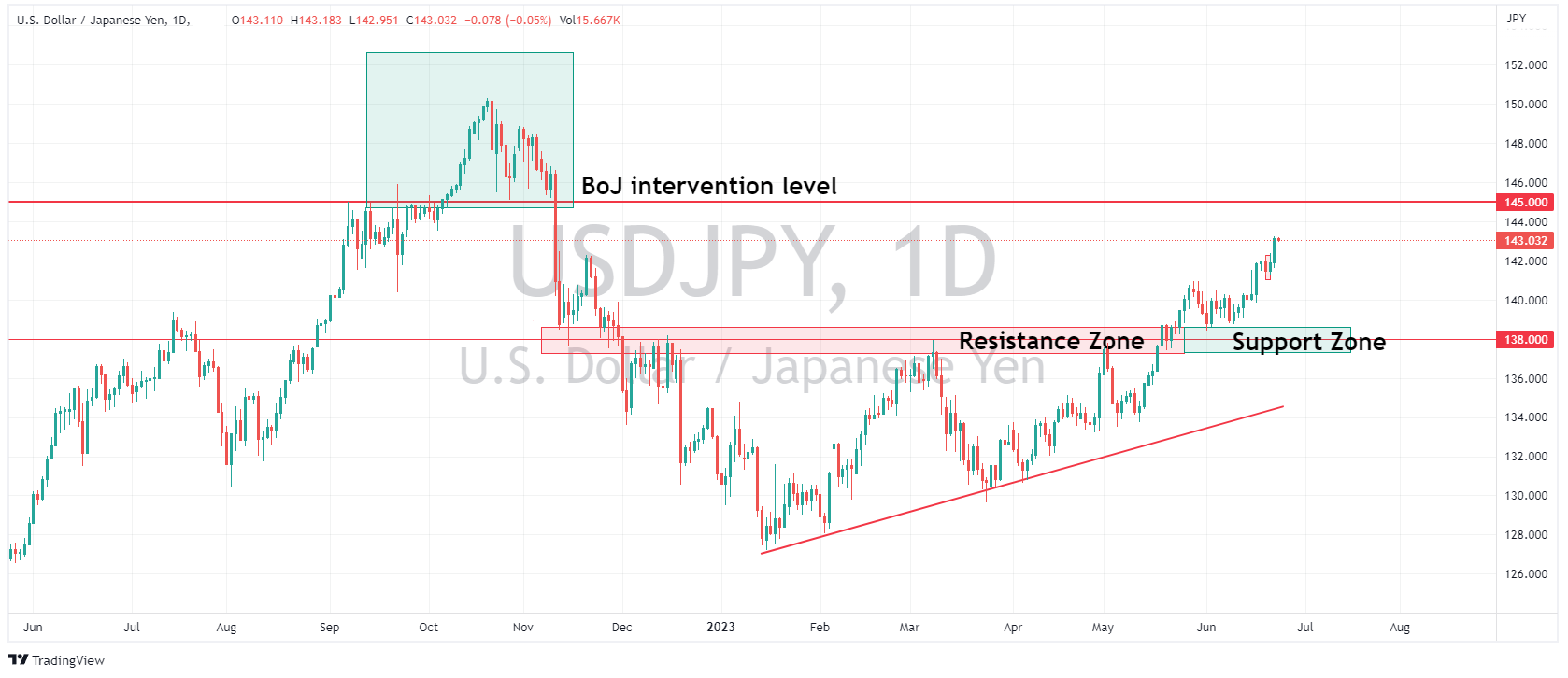

JPY was the G10 underperformer with USDJPY printing a fresh 2023 high of 143.22 after breaching the key 142.50 level , with a CPI report coming up today, another close above this level could see a technical continuance to test the 145 level. Recent Fed speak has also raised the issue that US treasury yields are likely to continue to rally, increasing the rate differential between US10Y and JGBs which will also be a major tailwind to get the pair to 145, which is where the BoJ’s November USDJPY intervention was launched.

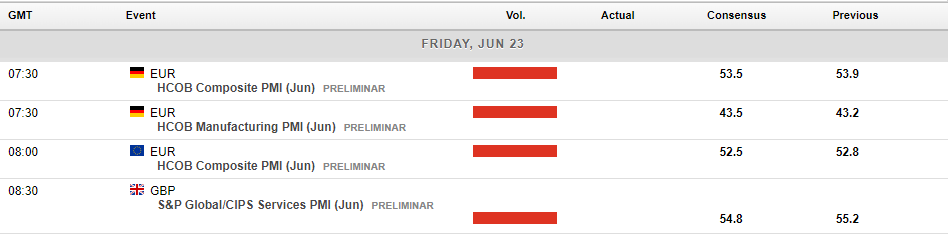

Todays calendar of major risk events below:

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

GBPJPY Breaks Through to 2015 Levels

The GBJPY has continued to climb strongly to the upside, since the end of March 2023 and currently trades just below the 183.00 price level. This move higher is driven by a combination of the weakness of the Japanese Yen and renewed strength in the British Pound. The Bank of Japan (BoJ) has begun to sound warning bells regarding potentially exce...

June 28, 2023Read More >Previous Article

AUDUSD testing key support after RBA minutes

The RBA minutes of their June meeting where another surprise hike had most of the market off side were released today, and they were surprisingly dovi...

June 20, 2023Read More >