- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – DXY flat, JPY rangebound ahead of BoJ, AUD NZD underperform on China woes

- Home

- News & Analysis

- Forex

- FX Analysis – DXY flat, JPY rangebound ahead of BoJ, AUD NZD underperform on China woes

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – DXY flat, JPY rangebound ahead of BoJ, AUD NZD underperform on China woes

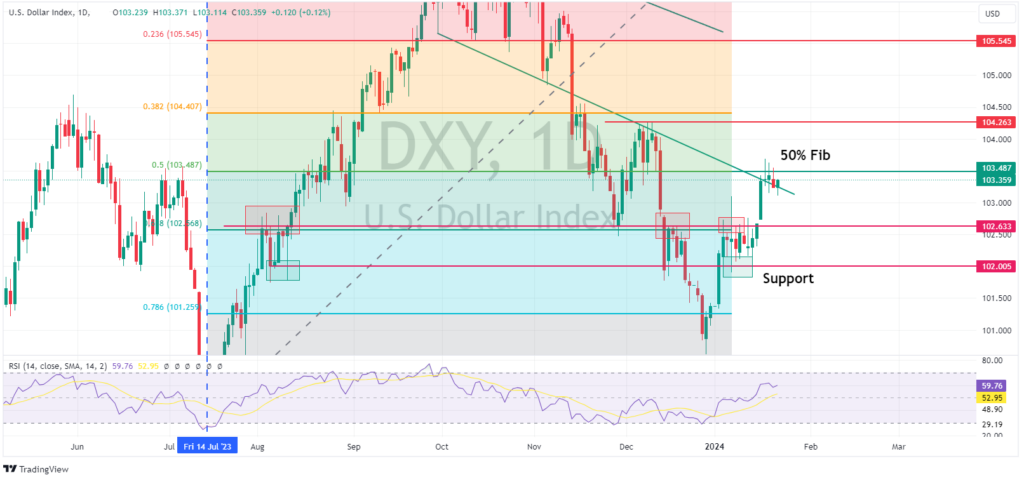

23 January 2024 By Lachlan MeakinUSD was flat in Monday’s session with DXY trading in a tight range from 103.110-103. 370 amid a light economic calendar ahead of the major risk events from Tuesday onwards. DXY still capped to the upside by the 50% Fib level resistance as traders look to be waiting for rate decisions from the BoJ, BoC and ECB before taking a USD view.

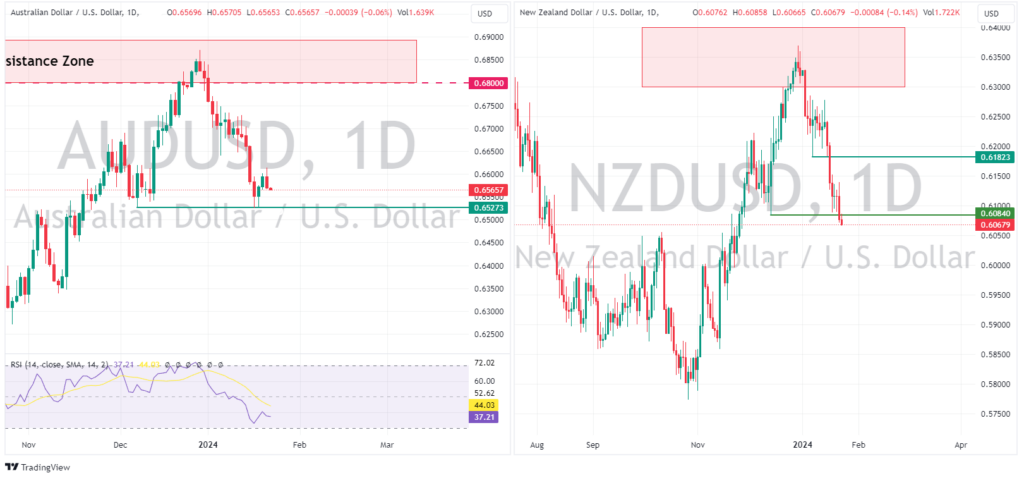

AUD, and NZD were the G10 underperformers. AUDUSD trading just above 0.6600 early in the APAC session before reversing course and retracing all of Friday’s gains. NZDUSD breaking support at 0.6084 to set new 2024 lows. AUD and NZD weighed on by a broad-based selling in the Chinese market.

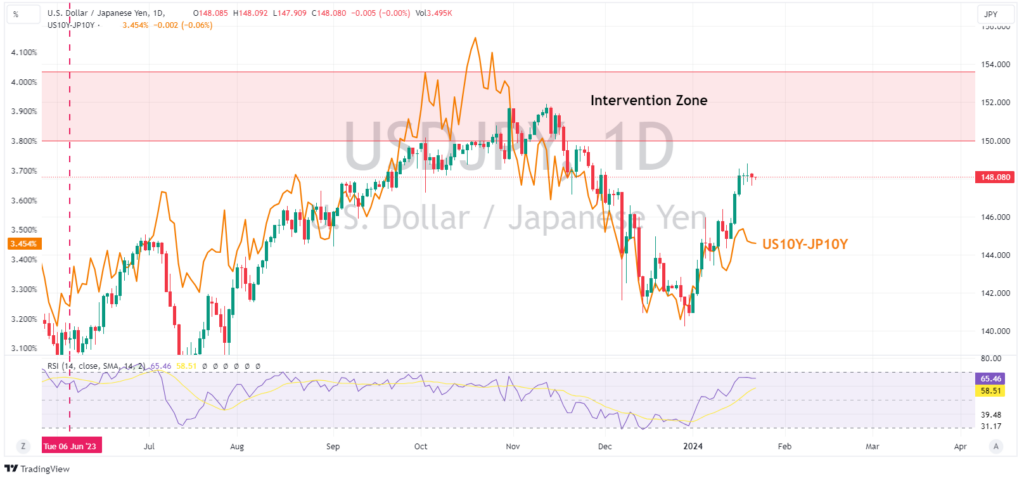

JPY was flat against the USD ahead of today’s BoJ policy meeting. Comments from Japanese PM Kishida requesting firms provide larger pay rises this year supporting the Yen somewhat. The BoJ isn’t expected to make any changes to current easy money policy but any mention of a timeline for rate normalisation would be Yen positive. USDJPY still trading in a tight range, just holding the key level of 148 coming into the BoJ announcement.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Tesla Q4 Earnings Preview – Can a strong report turn the stock around?

TSLA comes into Wednesdays Q4 earnings report having taken a beating so far is 2024, with the stock price down almost 16% in the first 4 weeks of the new year. Q4 was a quarter that saw the company’s deliveries trend higher, driven by stronger sales of its entry-level vehicles following price cuts, an upside surprise may be on the cards lending r...

January 23, 2024Read More >Previous Article

The Week Ahead – BoJ, ECB, BoC meetings headline – the charts to watch.

Markets enter the new week with risk-on firmly the narrative with all three major US indexes hitting all-time highs last week. In FX markets, the posi...

January 22, 2024Read More >