- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – AUDUSD and Gold get a boost, JPY spikes on possible intervention.

- Home

- News & Analysis

- Forex

- FX Analysis – AUDUSD and Gold get a boost, JPY spikes on possible intervention.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – AUDUSD and Gold get a boost, JPY spikes on possible intervention.

14 November 2023 By Lachlan MeakinAUDUSD

AUD saw gains to come within a whisker of the key 0.64 level, after hawkish leaning commentary from RBA Assistant Governor Kohler, who noted the decline in inflation is more gradual than previously thought. The Aussie also helped by a weaker USD and improved risk sentiment. The 0.64 level will be key in the near term as the mid-point of AUDUSD 3-month trading range is likely to act as resistance and support and will dictate which side of the range AUDUSD will be testing next.

USDJPY

USDJPY rose to fresh peaks of 151.92 before a sharp move lower in the cross was observed without any clear catalyst which of course generated suspicions of intervention, especially given the move happened around 10am EDT, where intervention has occurred before. Also adding to the intervention narrative was comments from Japanese Finance Minister Suzuki during the Asian session where he spoke of “undesirable moves in the FX market”. USDJPY fell sharply from 151.92 to 151.19 but did retrace back to 151.70 after the dust settled, if this was a BoJ intervention it seems the 152 level may be the line in the sand and one to watch closely for Yen traders.

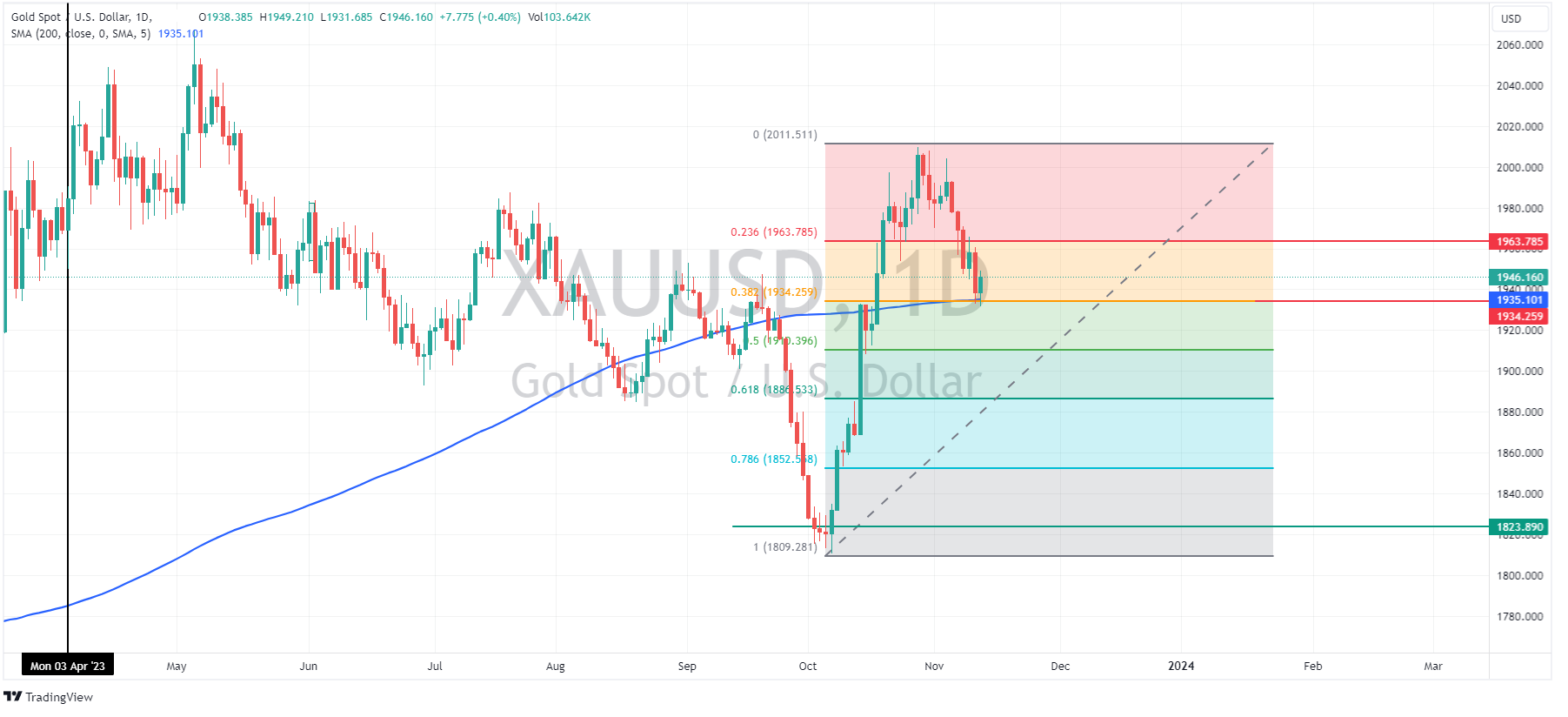

XAUUSD

Gold rallied on Monday, recouping around half of Fridays losses after finding support at its the Oct lows to highs 38.2 fib retracement level which also matches up with the 200-day SMA. A weaker USD and falling yields also giving gold a boost along with residual safe haven demand.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Home Depot shares rise after earnings

Home Depot Inc. (NYSE: HD) released its latest financial results before the opening bell in the US on Tuesday, beating analyst estimates for the third quarter. Company overview Founded: February 6, 1978 Headquarters: Atlanta, Georgia, United States Number of employees: 471,600 (2023) Industry: Retail Key people: Ted Decker (Pres...

November 15, 2023Read More >Previous Article

Charts to watch in the week ahead – AUDUSD, USDOLLAR, GBPUSD

Last week’s action in the FX markets was shaped by a pushback by the Fed chair Jerome Powell and assorted other Fed members on markets pricing in a ...

November 13, 2023Read More >