- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- EURAUD testing mean of long-term range

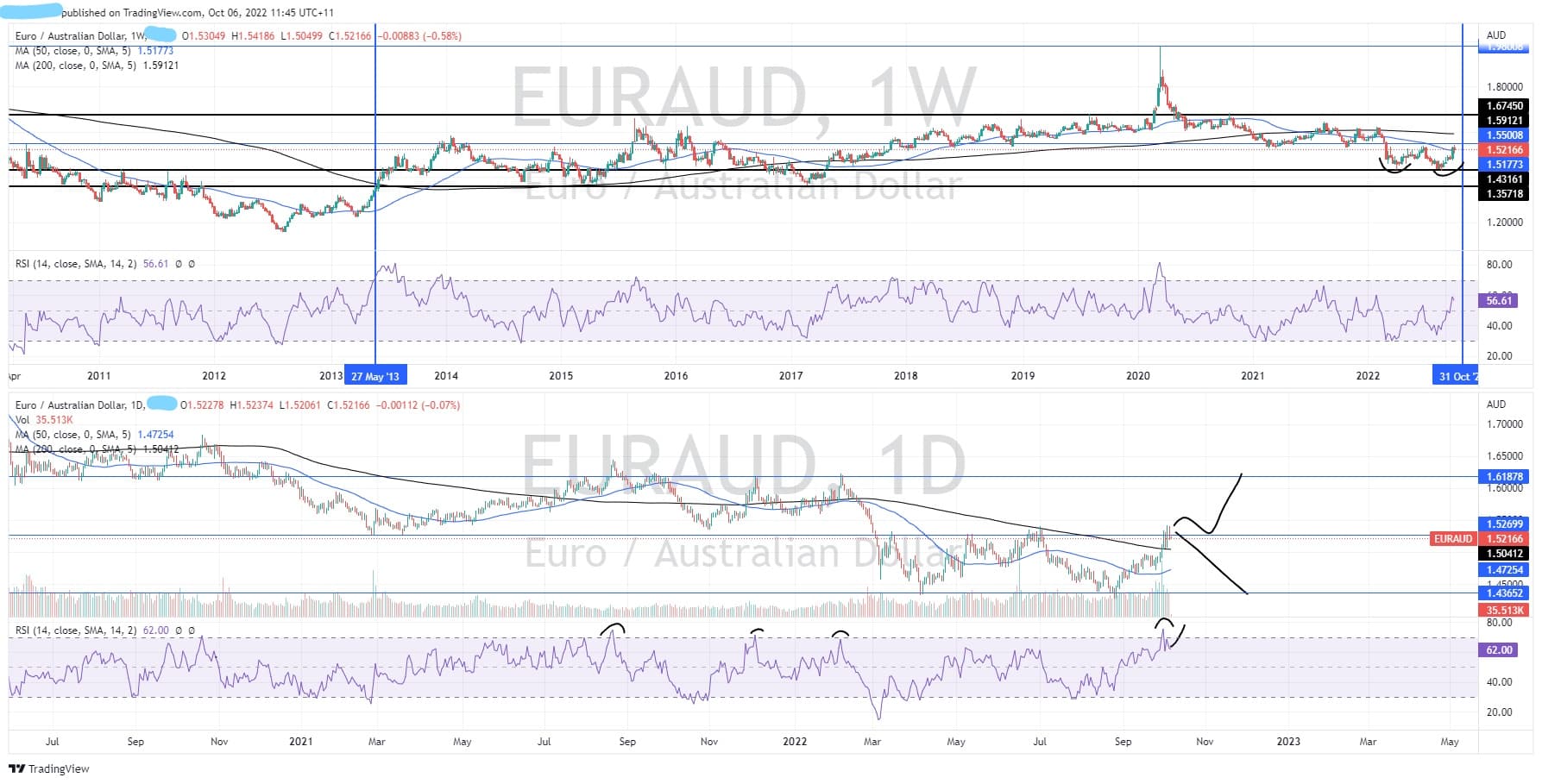

News & AnalysisThe EURAUD buoyed by a weaker Australian Dollar lighter lighter monetary policy from the Reserve Bank of Australia, (RBA) has seen the currency pair move with some momentum in recent days and weeks. The RBA came out in its most recent meeting and raised rates by an unexpectedly low 25 bps vs 50 bps. This helped equities and housing stability but pushed the AUD to very lows levels. The Euro on the other hand has suffered with geopolitical conflicts and recessionary pressures that have hit major players in the Union. With Germany in particular suffering quite large inflationary issues putting severe pressure on the EUR. After to dipping to as low as 1.42 AUD in both April and August this year, the pair has been able to move back into the major range that the price has been holding since 2013, excluding the commencement of the pandemic.

Technical Analysis

The weekly chart as discussed above highlight that this pair does not usually trend and if it does trend it tends not hold the trend for very long. Rather the price tends to hold a range with breaks of range usually the outcome of extreme economic events such as the GFC or the pandemic before retreating into the range. The weekly chart also indicates that the price may be ready to reverse back up as seen by the double bottom pattern that has formed. The neckline needs to be broken by the price at 1.54 for the pattern to be confirmed. The question is whilst this price is showing signs of a reversal, the price is sitting just on a significant resistance area.

The daily chart shows an interesting case for either a breakout or a breakdown. Firstly, the price has so far not broken out completely and is still consolidating at the neckline. In addition, the price is overbought to a high level and on previous occasions when it was this overbought, it has fallen back down. However, it is possible that the RSI is also just consolidating and getting ready to breakout. This chart needs a little bit more time to be sure of a direction, however a potential long target if it breaks out to the long side could be 1.60 and to the short side if it fails could be 1.42.

With economic still to flow for both Australia and Europe the EURAUD is definitely one to keep an eye on.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Technical Analysis – Retracement for US Dollar

Starting from the weekly timeframe, US Dollar Index has been consistently trending upwards for the last 16 months. Using the 9 exponential moving average (EMA) on the weekly time frame, we can see the US Dollar retracing back to the EMA, bouncing off of it, then continuing with the trend, as seen below: Looking at the structure of the uptren...

October 7, 2022Read More >Previous Article

China Yuan’s Falls to Record lows

I have recently written a piece on the weakening of the Great British Pound (GBP) just the other day, as it looks like the dollar seems to be king...

October 4, 2022Read More >