- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Forex

- Be prepared and trade smart with the MT4 Genesis Session Map

- Home

- News & Analysis

- Articles

- Forex

- Be prepared and trade smart with the MT4 Genesis Session Map

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisForex is one of the heaviest news driven markets in the world. Major news announcements play such a critical role to the intraday volatility, which in turn create trading opportunities. Most of the time, particularly for the active traders, market volatility can present more trading opportunities.

So it stands to reason, all Forex traders should be very mindful of upcoming news announcements. Even if you are a position trader or someone who likes to hold your FX positions for the medium to long term, knowing what news is coming up is essential.

Tracking the markets across the globe

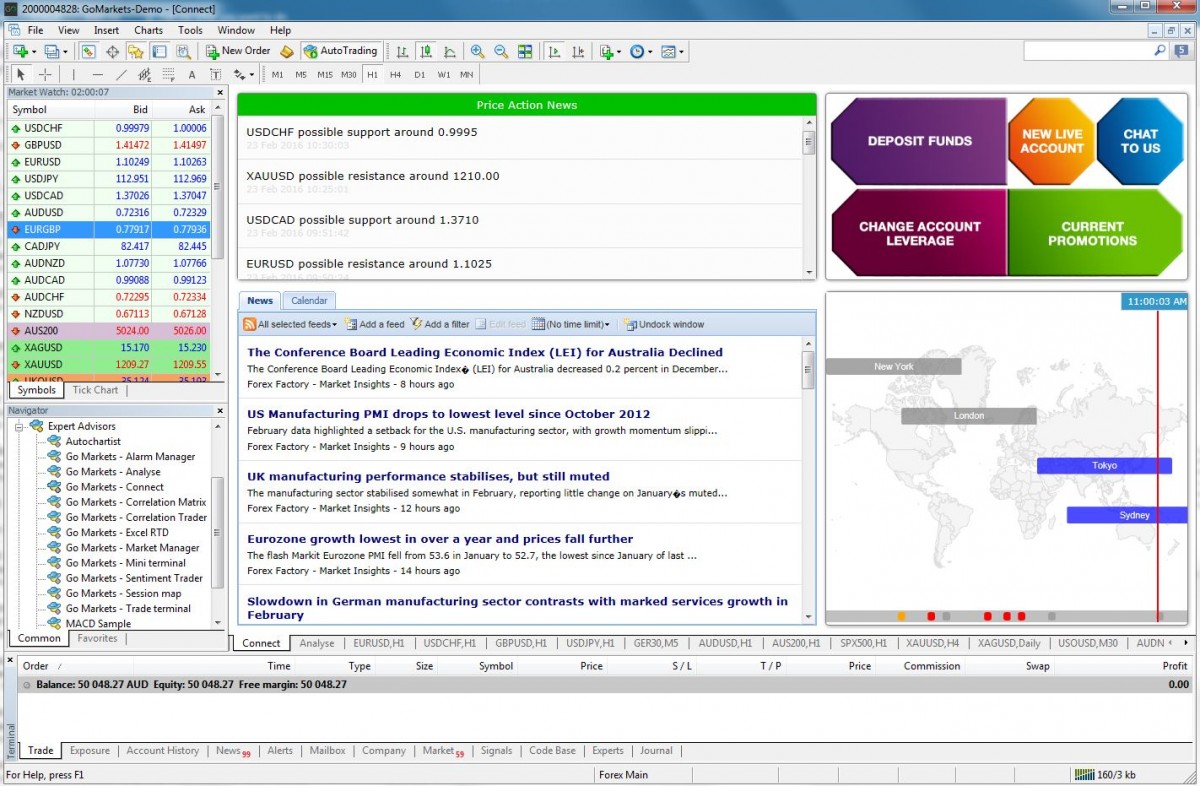

Using MT4 Genesis, the session map shows you the key trading times for the main ‘fixes’ around the world including Sydney, Tokyo, London and New York. Trading around the major fixes is important for those who trade on an intraday timeframe.

For example, it is important to note that the Australian session is first and it is often the quietest, unless of course there is a Reserve Bank of Australia (RBA) rates announcements or even the Reserve Bank of New Zealand (RBNZ) can be enough to move the markets on a regular basis.

Other than that, the Australian fix rarely moves the markets.

It is not until you get the crossover to the London session that volatility picks up. You can then expect more volatility when the London session meets the New York session. The session map shows a clear red line for your current time so you can see when volatility may pick up.

The best feature of the session map is the news markers. At the bottom of the session map window, you will see grey, orange and red markers, highlighting upcoming news announcements.

Grey is low impact, orange is medium impact and red is high impact. By hovering your mouse over the news markers (or left clicking on one), you can see:

» what the announcement is;

» the time is will be released; and

» its expected impact.How many times have you had an open position rally significantly, to then have to scour the internet for a news item related to your currency pair? If you’ve been trading for any length of time, then probably too often.

By applying the session map, you can see clearly what news is driving the spike.

Another great aspect of the session map is the ability to see your current open profit and loss at a glance. In addition, you have a host of other account details with one click, such as your:

» balance;

» equity;

» floating P&L;

» margin in use; and

» the amount of margin you have free.Applying session map is as easy as dragging it from the Expert Advisors folder straight on to your chart. It’s that easy.

Stay on top of the markets by using Connect and Analyse tools

It’s been said that trading could be a lonely job, particularly if you’re trading on your own. While market action and price movements can definitely keep you on your toes, some people find it a bit isolating at some stage.

However, you can look at it as being on top of the world (or the markets, at least) as you need to keep tab of what’s happening across the globe. This is particularly true when trading the forex (FX) market as currencies tend to move pretty fast compared to equities.

Using the Connect and Analyse tools in MT4 Genesis, you can be a step ahead already. These tools will give you current and relevant information – breaking news, statistics and analysis – that you can use for your trading.

These tools are readily available from within your GO Markets’ MT4 platform. Once the MT4 Genesis file has been run, the full suite of tools will be available from the Expert Advisors tab. Simply left click and drag each tool on to the chart of your choice.

Let’s have a look at the features of the Connect function.

As a trader, you need to be in tune with market developments as well as current events and news that may impact the markets. The Connect window will give you price action and technical updates on the relevant currency pairs.

This is also where you can find news updates not only about the markets, but also general news. Monitoring the news is vital for your trading as big events can have a major impact on the markets.

For example, decisions and announcements from the US Federal Reserve are always being watched and monitored by traders because it could affect currency movements. Major decisions from the US Fed are notorious for having effects on other currencies.

Using this feature, you can select a number of news providers that suit your information needs.

The Connect feature also has a calendar that informs you of all relevant upcoming announcements that may affect the FX market. The calendar highlights:

» High-impact events

» Medium-impact events

» Low-impact eventsSome of the high-impact events that usually generate big moves in the market include:

» US non-farm payroll announcement

» US Federal Reserve announcements

» Retail sales data

» Manufacturing dataAnother way to connect with the market and to make sure you’re on top of current developments is via the GO Markets website. Using this feature, you can do several things such as:

» Open a new account

» Deposit funds

» Change the leverage on your account

» Access current promotions or simply

» Speak with one of the Go Markets’ team members.Analyse tool

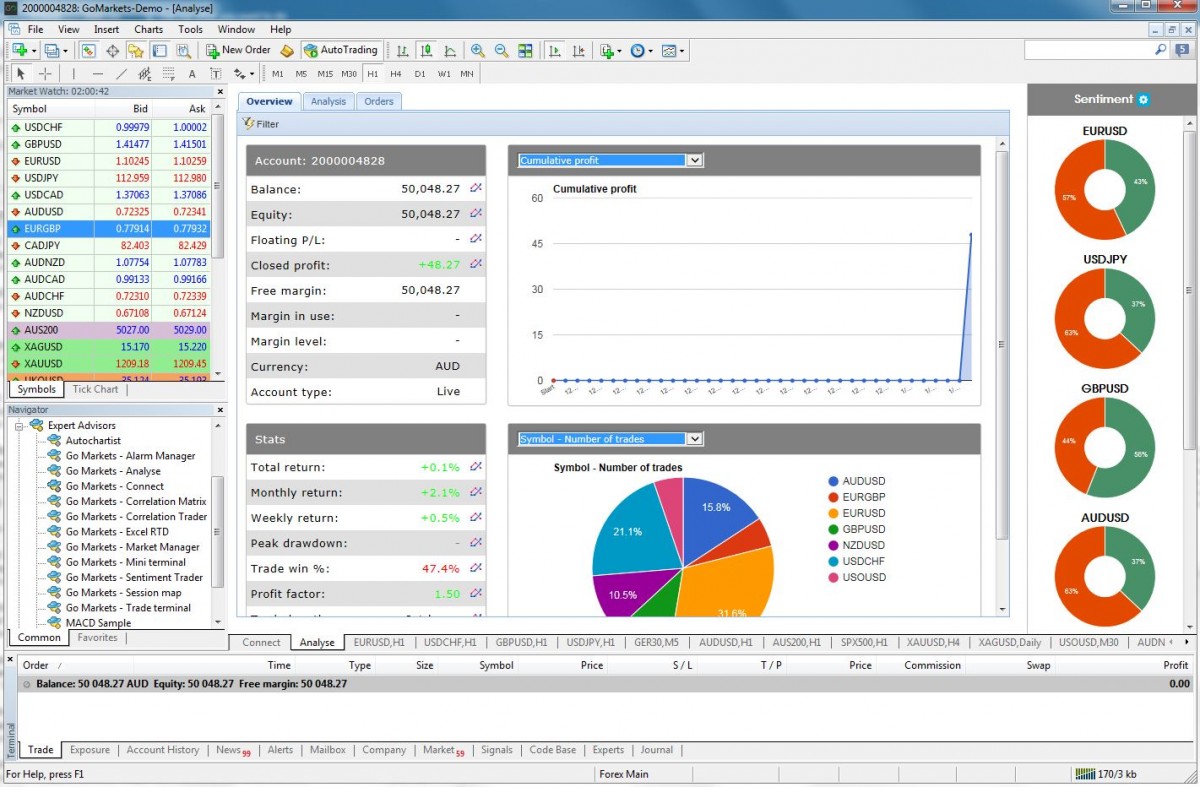

The Analyse tool is also helpful if you want to do weekly, monthly or yearly review of your trading performance. As a trader you would like to know how you’re performing and you would like to keep track of some vital statistics including:

» Account Balance

» Profit

» Profitability

» Percentage return

» Monthly returnSentiment indicator

The sentiment indicator is another key feature that can be useful for your trading. Using this tool, you can identify the currency pairs you want to trade (or in your watch list) and see the bias towards long and short positions on those pairs. This will give you a good appreciation of the overall market sentiment on a particular currency pair.

For example, the falls in iron ore and oil prices are widely expected to have negative impact on commodity currencies including the Australian dollar. However, despite the negative sentiment, the Aussie dollar is still being supported at a healthy level.

Using the sentiment indicator, you can see how other traders are ‘feeling’ about the Aussie dollar as it would be reflected on the number or percentage of long positions versus short positions.

Take advantage of the Connect and Analyse tools as they could make a big difference in your trading performance.

The opinions and information conveyed in the GO Markets newsletter are the views of the author and are not designed to constitute advice. Trading Forex and CFD’s is high risk.

Rom Revita | Sales Manager Rom is the Sales Manager at Go Markets Pty Ltd and manages the day-to-day running of the Sales, Support and Marketing teams. He has been with the company since 2013 and is also one of our two appointed Responsible Managers, helping to ensure that the company follows all AFSL regulatory requirements.

Rom has extensive financial markets experience and originally comes from an equities & derivatives trading background. He has served on the Trading & Sales Desk with several large broking houses, and now specialises in Margin FX and CFDs.

Connect with Rom: [email protected]

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Point & Figure Analysis – A Japanese Cliffhanger

Annihilation of the Yen It was the year 2013. Some interesting events took place that caused some reverberations in global markets. The once one booming city of Detroit (known for its car manufacturing) filed for bankruptcy and the US government shutdown for almost two weeks. But the most significant story was the fall of the Japanese currency a...

February 24, 2016Read More >Previous Article

Where to for the Aussie dollar in 2016?

Another year down, and another year spent under pressure for the Australian dollar. If January’s performance is any indication, 2016 may very well b...

January 28, 2016Read More >