- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- AUDUSD Soars on RBA Hike, EURUSD underperforms, CAD, GBP, JPY wrap

- Home

- News & Analysis

- Forex

- AUDUSD Soars on RBA Hike, EURUSD underperforms, CAD, GBP, JPY wrap

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisAUDUSD Soars on RBA Hike, EURUSD underperforms, CAD, GBP, JPY wrap

7 June 2023 By Lachlan MeakinUSD was firmer on Tuesday amid a light news calendar sparse in any key risk events. The US Dollar index again having a choppy session in a tight range with EURUSD weakness giving the Dollar a tailwind, also helping the greenback was ramped up US growth forecasts from Goldman Sachs and the World Bank hitting the wires.

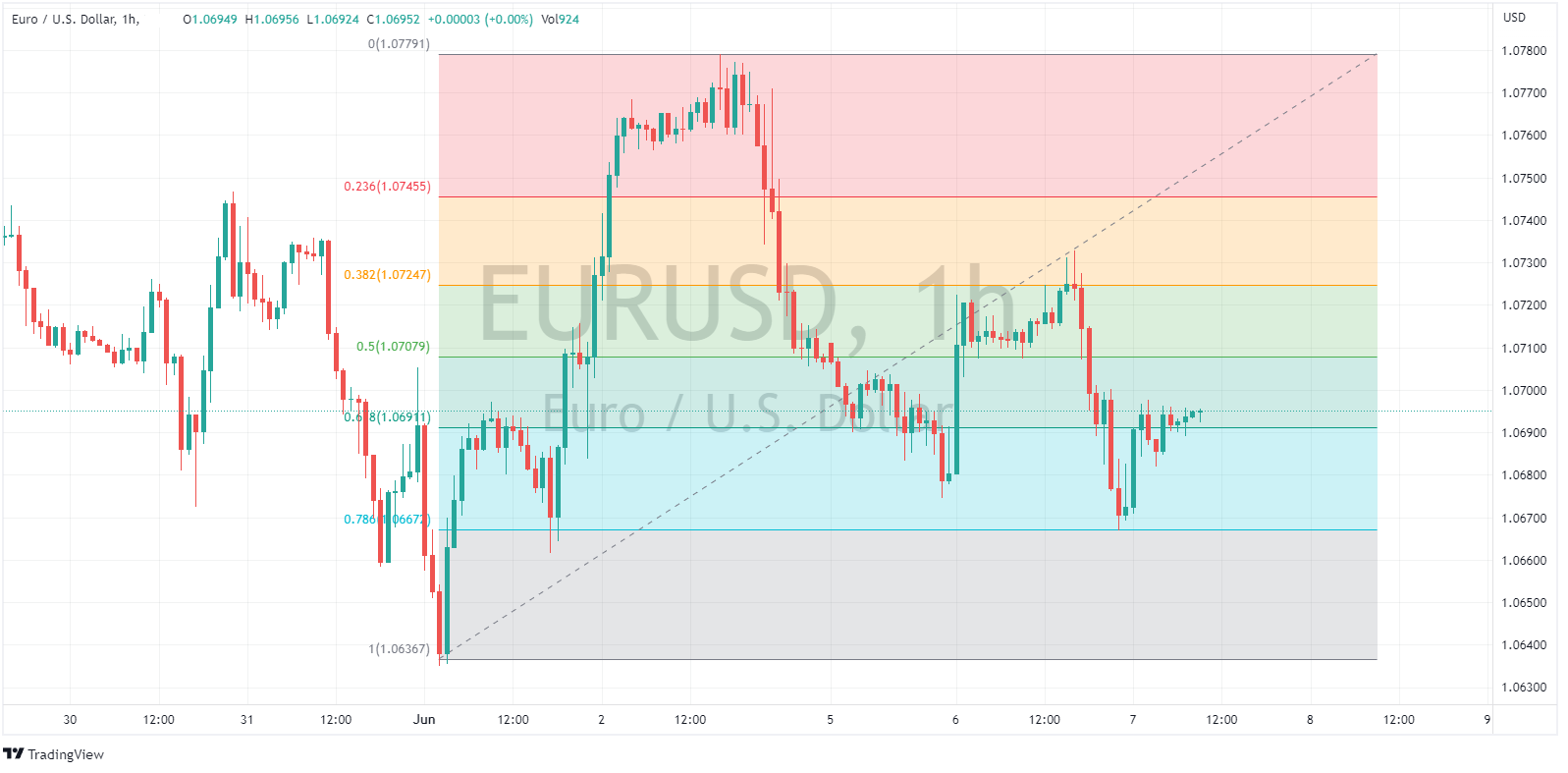

EUR was the G10 underperformer to see EURUSD hit lows of 1.0668 before finding support at a Fib level, this following a miss in German Industrial orders and an ECB consumers survey showing a sharp decline in inflation expectations. Adding to the dovish tone was comments from ECB member Knot (a known hawk) who made some dovish comments declaring “the worst of inflation is behind us”. More ECB talk is scheduled for Wednesday which could add to this narrative.

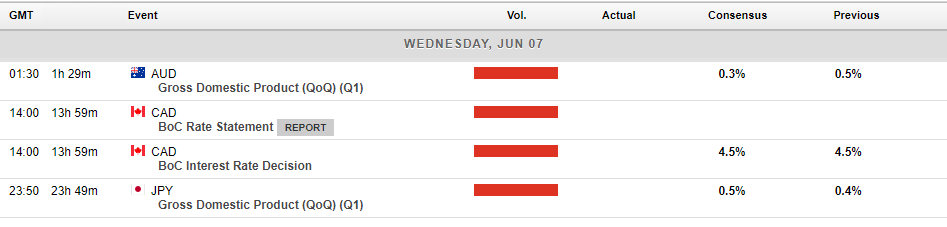

CAD managed to eke out some gains against the Dollar in a whipsawing session, USDCAD seeing a low low of 1.3391, breaching the key support level at 1.34.CAD was initially weighed on by lower oil prices, but an improved growth outlook saw Crude oil rebound with the CAD following suit. Later today CAD traders will have all eyes on the BoC rate decision where the Central Bank is expected to hold rates at 4.5%, but there is a distinct possibility of a 25bps hike in the wake of the recent beats on GDP and CPI readings. Current market pricing has a 46% chance of a hike priced in, so will be line ball.

GBP and JPY were modestly higher against the USD on the session. JPY pared some of its initial strength by a rise in UST yields widening the UST-JGB differential. GBPUSD traded within a tight range, printing a low of 1.2392 and a high of 1.2458. Weak home building figures and a rising recession fear capping gains on cable as the BoE’s aggressive rate hiking campaign appears to be slowing the economy.

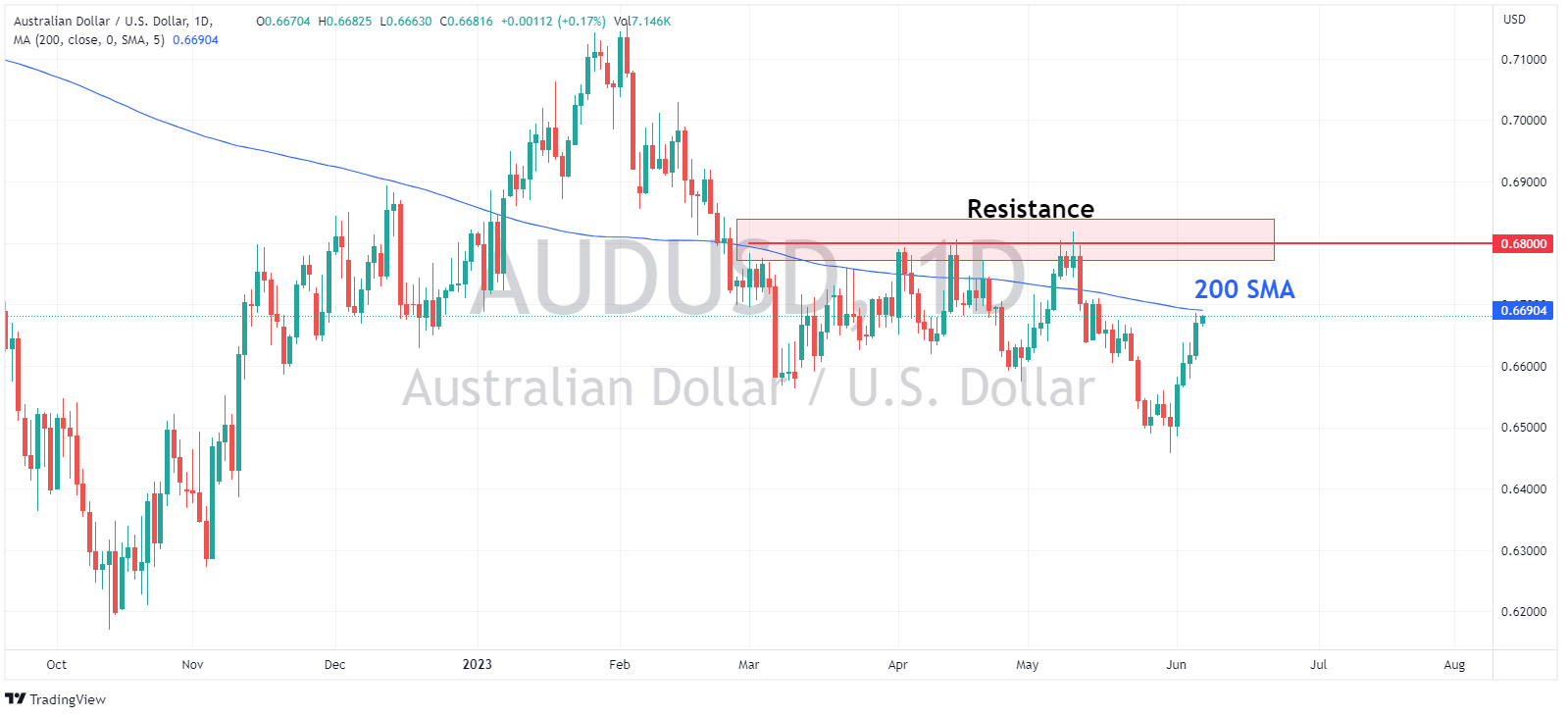

AUD was the clear G10 outperformer after the RBA surprised the market again with a 25bps hike to 4.10%, which along with a hawkish RBA statement noting further rate hikes “may be required” seeing AUDUSD hit a high of 0.6685, falling just short of the 200DMA at 0.6692 and holding most of the gains post announcement throughout the session. For AUD watchers today Q1 GDP will be released today at 11:30 AEST, though it could have limited impact given the RBA already opted to hike rates yesterday.

Calendar of today’s major risk events:

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Asia Morning FX – AUD and EUR surge, USD takes a hit post FOMC, BoJ ahead

USD tumbled in Thursday’s session in the wake of a dovish Powell presser (relative to statement/dot plots) saw the Dollar bears in charge. This, coupled with a hawkish ECB and mixed US data saw DXY fall from highs of 103.38 in the European morning to a low of 102.08, with the psychological 102 level the next obvious support. A hawkish ECB, where ...

June 16, 2023Read More >Previous Article

Could the Reserve Bank of Australia hike rates further?

The Australian interest rate is currently at 3.85% and the most recent consumer price index (CPI) released at 6.8% which indicates slightly higher tha...

June 6, 2023Read More >