- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Asian Open – Hawkish FOMC sees US stocks slide again, USD rally. JPY clobbered, AUD dips ahead of Jobs Data.

- Home

- News & Analysis

- Forex

- Asian Open – Hawkish FOMC sees US stocks slide again, USD rally. JPY clobbered, AUD dips ahead of Jobs Data.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisAsian Open – Hawkish FOMC sees US stocks slide again, USD rally. JPY clobbered, AUD dips ahead of Jobs Data.

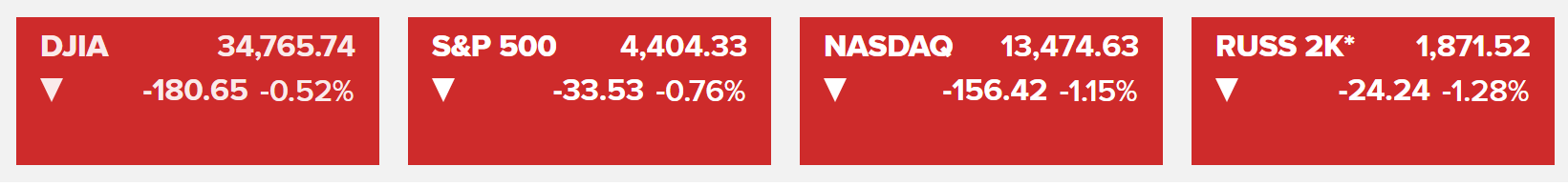

17 August 2023 By Lachlan MeakinAsian indices are looking to open soft in Thursday’s session after major US Indices extended their sell-off in Wednesdays session on stronger than expected US data and a “hawkish” FOMC minutes where Fed officials saw ‘upside risks’ to inflation possibly leading to more rate hikes. The Russell 2000 led losses (-1.28%) in the US on the continued underperformance of regional banks, though the risk sensitive Nasdaq (-1.15%) wasn’t far behind in a broad-based sell-off.

FX Markets

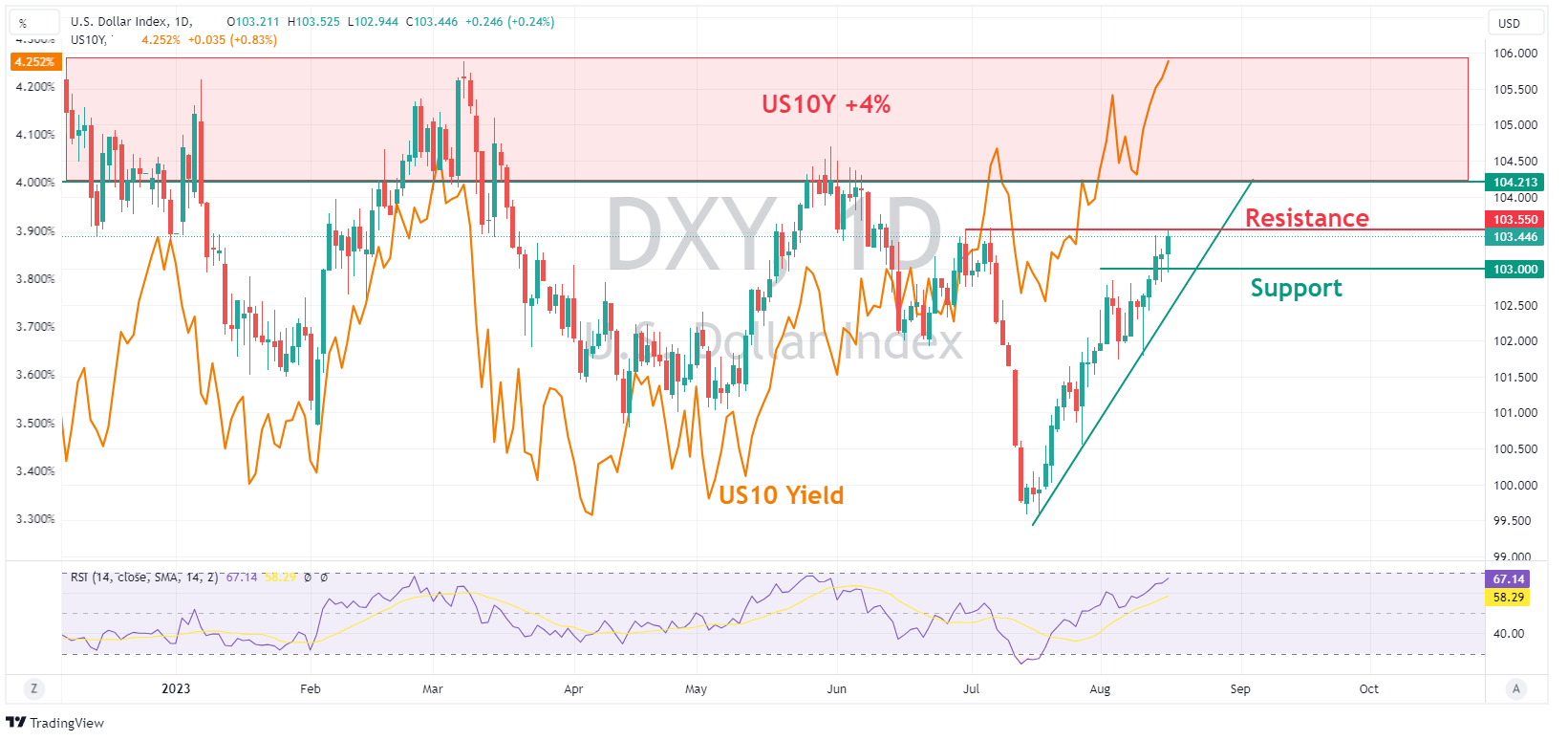

A jump in US treasury yields, which saw the US 10 year pushing higher above its 4% resistance level, and a risk off tone in the market saw the USD surge higher again, DXY testing and holding the big 103 level and pushing up to test cycle highs resistance at 103.55. Strong US data (Industrial Production smashing expectations) and the aforementioned FOMC minutes also being strong tailwinds for the USD.

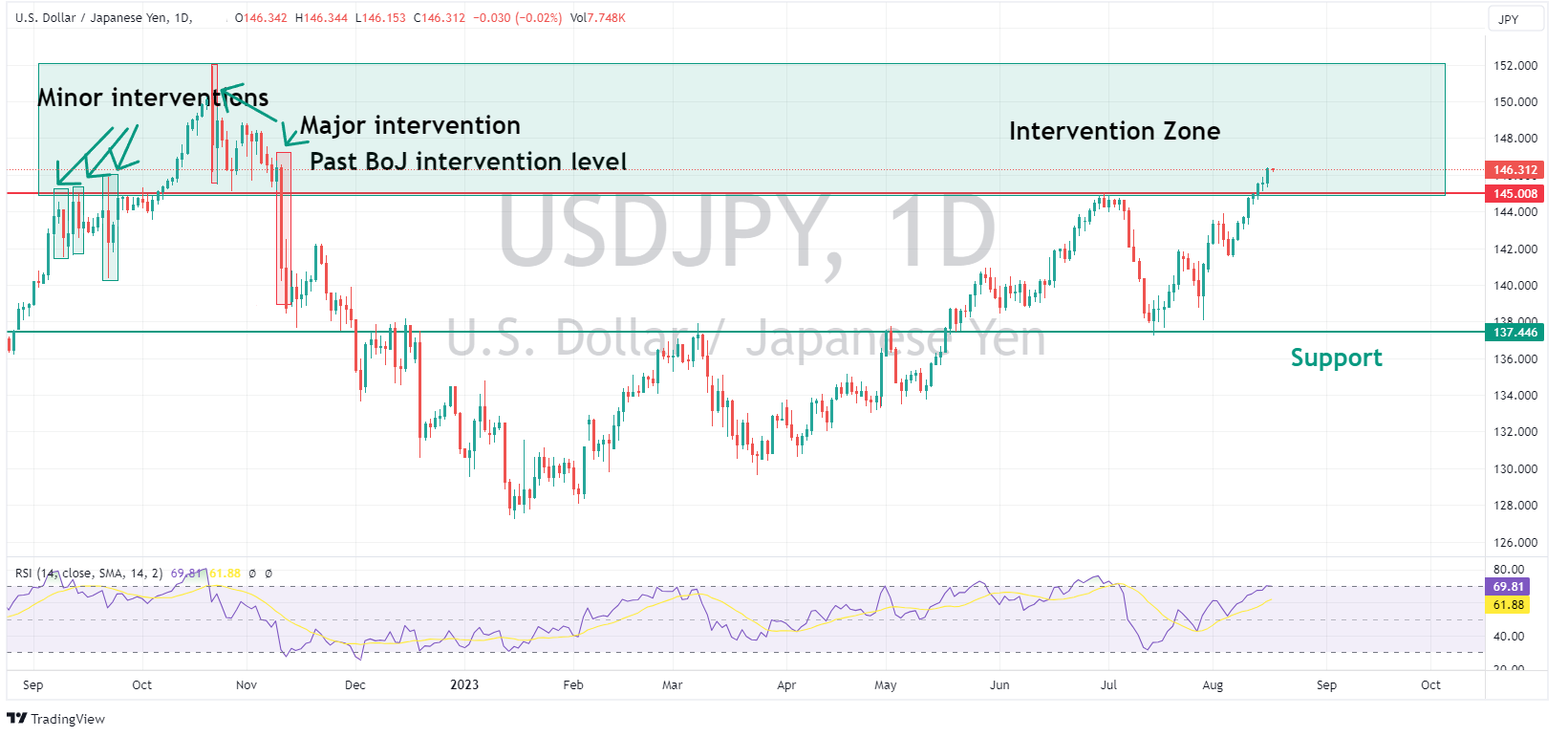

JPY was markedly weaker on a perfect storm of rising US10 and JP10 yield differentials and a rampant USD. USDJPY hit a high of 146.38, well into the “intervention zone” where the BoJ entered the market to strengthen the Yen late last year. There is Japanese CPI data on Friday, but my feeling is nothing short of robust BoJ action will reverse this grind higher in USDJPY.

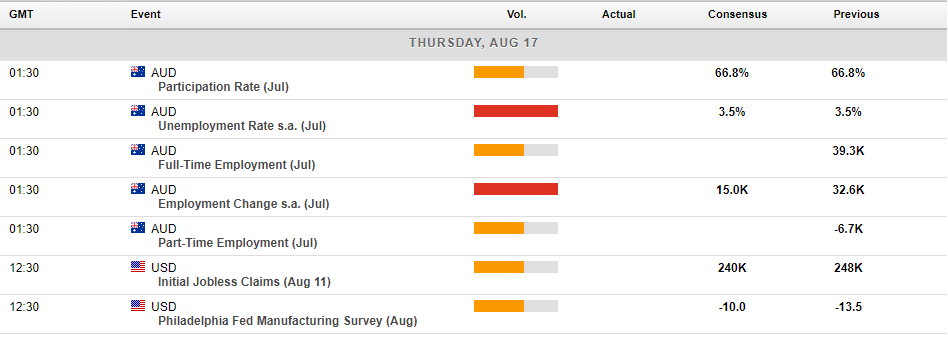

AUD and NZD were softer against the USD weighed down by the risk-off market tone and concerns about Chinas economic recovery. The Kiwi did outperformed the Aussie after Yesterdays RBNZ rate decision where they kept rates on hold but gave what was seen as hawkish forward guidance, this saw AUDNZD push down to test the big figure at 1.08 before finding some support. AUD traders have a pivotal employment report to look forward to today at 11:30 AEST

Gold continued its month-long downtrend, higher yields and a strong USD weighing heavily on the precious metal, with haven flows seeing to go anywhere but to Gold at the moment. XAUUSD pushing below its support level at 1903 USD an ounce and hitting lows not seen since March.

Today’s calendar is fairly light with the major risk events being jobs data out of Australia and the US later in the session.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

FX Analysis – CNH strengthens on intervention talk – JPY breaks losing streak – Gold breaks key support

FX WRAP USD was choppy with the US Dollar Index ending the session flat in range bound trade. Unemployment claims dropped to 239k from 250k the prior week which was in line with consensus and having little effect on the USD, though Philly Fed Manufacturing figures did have a big beat coming in at +12.0 vs an expected -9.8, which was the highest ...

August 18, 2023Read More >Previous Article

Market responses to actual versus consensus numbers in data releases

As traders and investors one of the important facts you need to get to grips with is the difference between Consensus (sometimes termed “expected”...

August 16, 2023Read More >