- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- Up Next: The Bank of Canada Rate Decision

News & Analysis

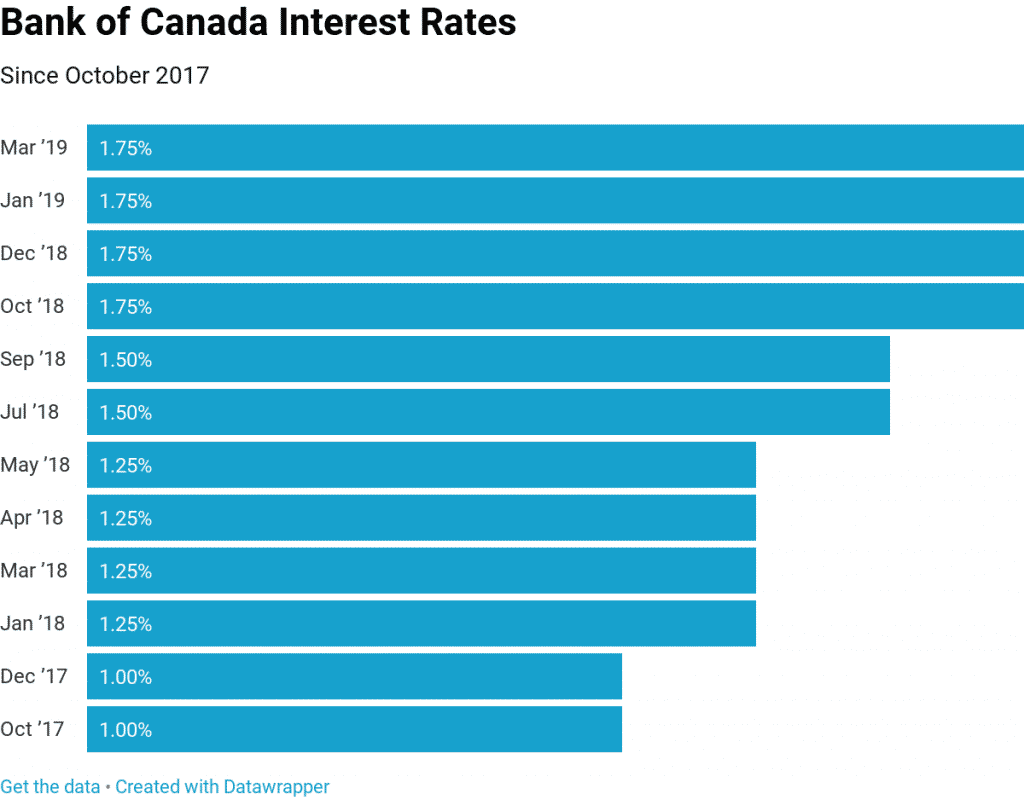

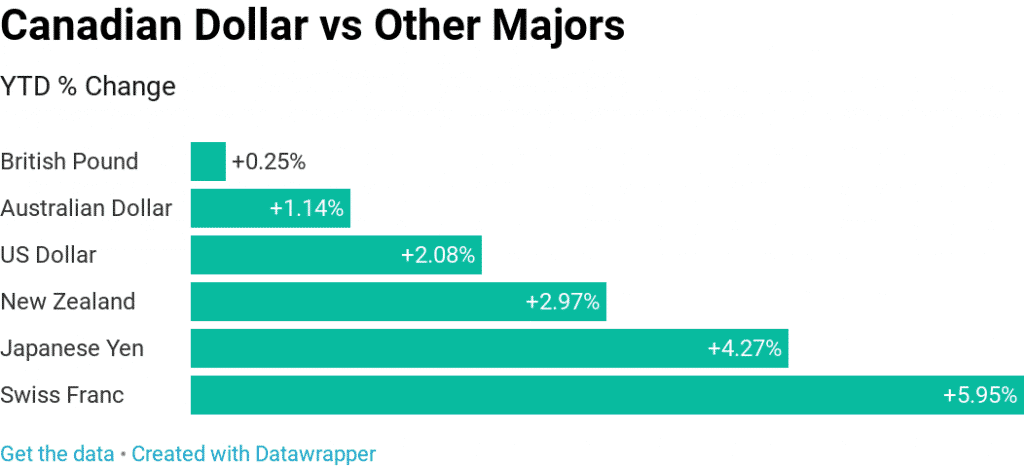

One of the must-watch economic events this week will be the Bank of Canada interest rate decision. The decision is scheduled to be announced on Wednesday 24th April at 15:00 PM London time.

Why Is The Announcement Important?

A bank interest rate is a rate at which a countries central bank lends money to local banks. The interest rate is charged by nations central or federal bank on loans advances to control the money supply in the economy and the banking sector. The Bank of Canada has an inflation target of 1% to 2% (currently 1.9%), and the interest rates are changed accordingly to meet the target. Therefore, the Bank of Canada’s and other central bank rate decisions can have a significant impact on the financial markets.

Expectations

The last time the Bank of Canada raised its key interest rates was back in October of last year and it is expected that the rates will remain unchanged at 1.75%.

The Bank of Canada Governor, Stephen Poloz has stated that further rate hikes this year are also unlikely, however, it will depend on economic data. ”That’s a very data dependent question”, Poloz said in a recent press conference when asked about potential interest rate hikes in 2019.

Even though the interest rates are likely to remain the same, traders will be keeping a close eye to the upcoming meeting and the comments at the press conference after the rate decision has been announced.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: DataWrapper, Bank of Canada

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Central Bank Interest Rates

Today, the Bank of Canada announced its decision to leave interest rates unchanged at 1.75% and with other major central bank policy meetings due to take place in the coming weeks, there is no better time to look at the current interest rates of some of the major central banks from around the world. About Interest Rates A bank interest rate is a ...

April 24, 2019Read More >Previous Article

GO Markets’ Giant Leap into MENA; Granted DMCC and DGCX Membership

MELBOURNE, AUSTRALIA – 18 April 2019. GO Markets is pleased to announce its expansion into the Middle East and Northern Africa (MENA) region, opera...

April 17, 2019Read More >