- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Central Banks

- Reserve Bank of Australia hikes Cash Rate by 0.50%

- Home

- News & Analysis

- Articles

- Central Banks

- Reserve Bank of Australia hikes Cash Rate by 0.50%

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe Reserve Bank of Australia, (RBA) has increased the Country’s cash rate by half a percent to combat the rising inflation in its latest cash rate change. The increase was in line with most analyst’s expectations as the RBA continues to fight inflation and bring it back into the 2-3% range. The current forecast from the RBA suggests that CPI inflation will peak near 7.75% over 2022, before falling to 4% during 2023, and then settling at 3% in 2024.

A key source of concern for the RBA was and continues to be the current spending habits of Australian households. Importantly, as the cost of goods has risen due to inflation, pressure has built on household budgets and their spending habits. This has been caused by both the supply chain issues and the increased cash rate. Furthermore, consumer confidence has fallen, and “housing prices are declining after the large increases in recent years.” This shows how interest rate hikes are impacting the lives of Australians and their spending habits.

Another important factor at play is the tightening of the job market. The unemployment rate dropped in June to 3.5%, the lowest rate in 50 years, and job vacancies and job advertisements continue to be at high levels. However, the bank does not expect to be able to hold these levels and predict the rate of unemployment will reach 4% by the end of 2024 as a result of the current slowing economic growth.

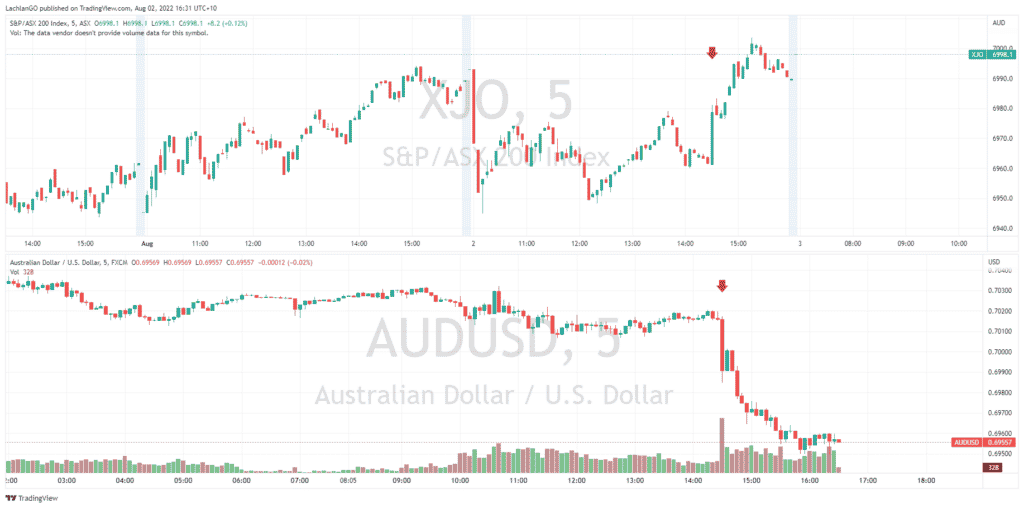

In response to the announcement, the ASX200 responded positively as investors saw the announcement as bullish, shooting up 0.38% in the 30 minutes after the announcement. Conversely, the AUDUSD dropped back below $0.70 dropping to $0.6970 in the 30 minutes immediately after the announcement.

The RBA will later this week further update the market with its monetary policy statement which will provide further clarity on its decision-making and the current sentiment.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

PayPal Q2 earnings results are here

PayPal Holding Inc. (PYPL) announced its latest financial results after the closing bell in the US on Tuesday. The US financial technology company reported revenue of $6.8 billion in Q2, topping Wall Street estimate of $6.778 billion. Earnings per share also beat analyst estimates for the quarter at $0.93 per share vs. $0.87 per share estimat...

August 3, 2022Read More >Previous Article

RBA preview – likely 50bp hike incoming

Todays RBA policy meeting is expected by most analysts to result in a 50bp hike as the bank tries to play catch up and get on top of elevated inflatio...

August 2, 2022Read More >