- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- Red hot inflation in UK points to 25bp hike, BoE and SNB preview.

- Home

- News & Analysis

- Central Banks

- Red hot inflation in UK points to 25bp hike, BoE and SNB preview.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisRed hot inflation in UK points to 25bp hike, BoE and SNB preview.

23 March 2023 By Lachlan MeakinBank of England

Headline February inflation in the UK came at a hotter than expected 10.4%, well above the consensus of a drop to 9.9% and indicating that Januarys dip to 10.1% seems to have been temporary.

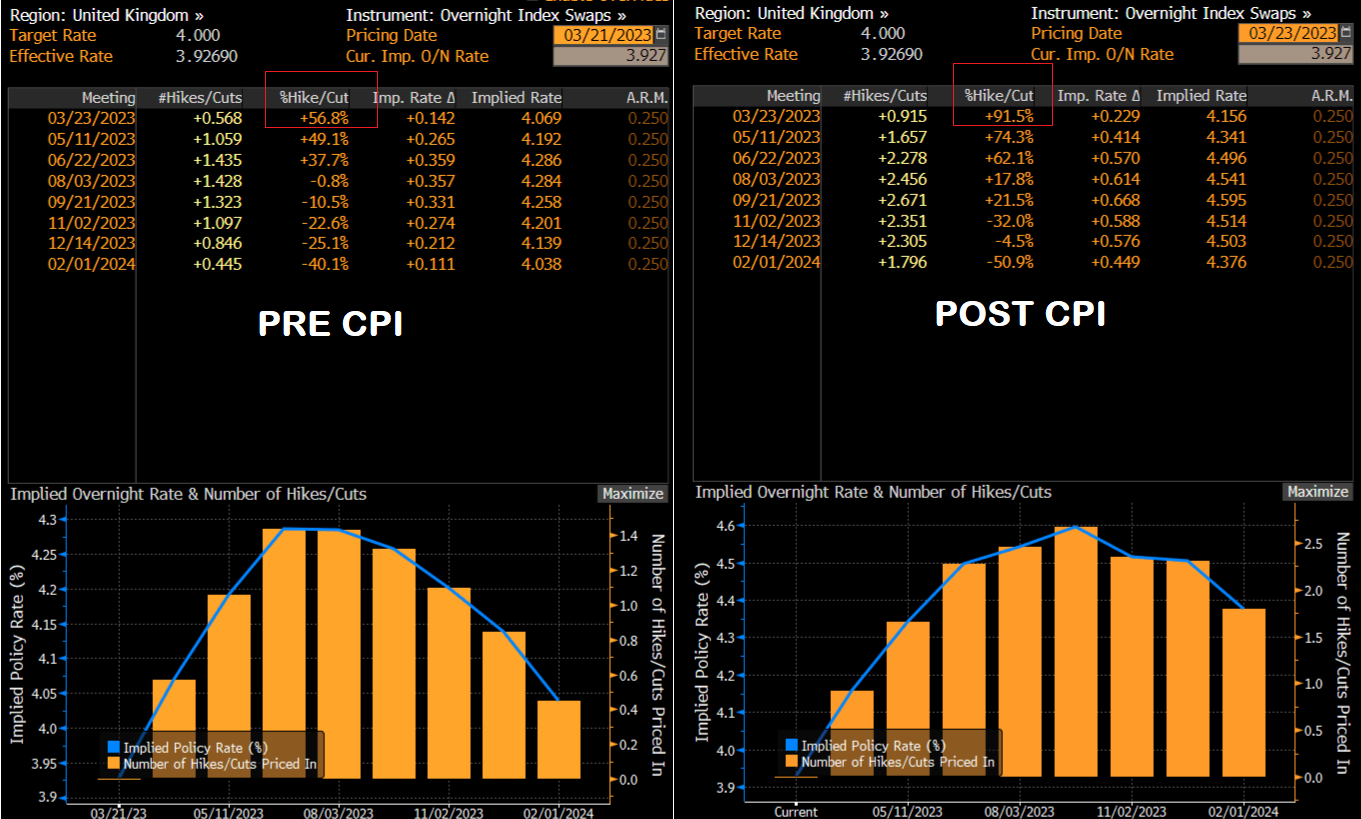

Unwelcome news for the BoE who have a rate meeting today, before this figure the decision seemed to be on a knife edge, with the markets pricing in a 50-50 chance of a 25bp hike or a hold, those odds have since blown out to make a hike pretty much a done deal with the market pricing in a 90% chance that the BoE will keep the tightening process going. The big change in hike expectations can be seen below, in the Pre CPI vs the Post CPI figures

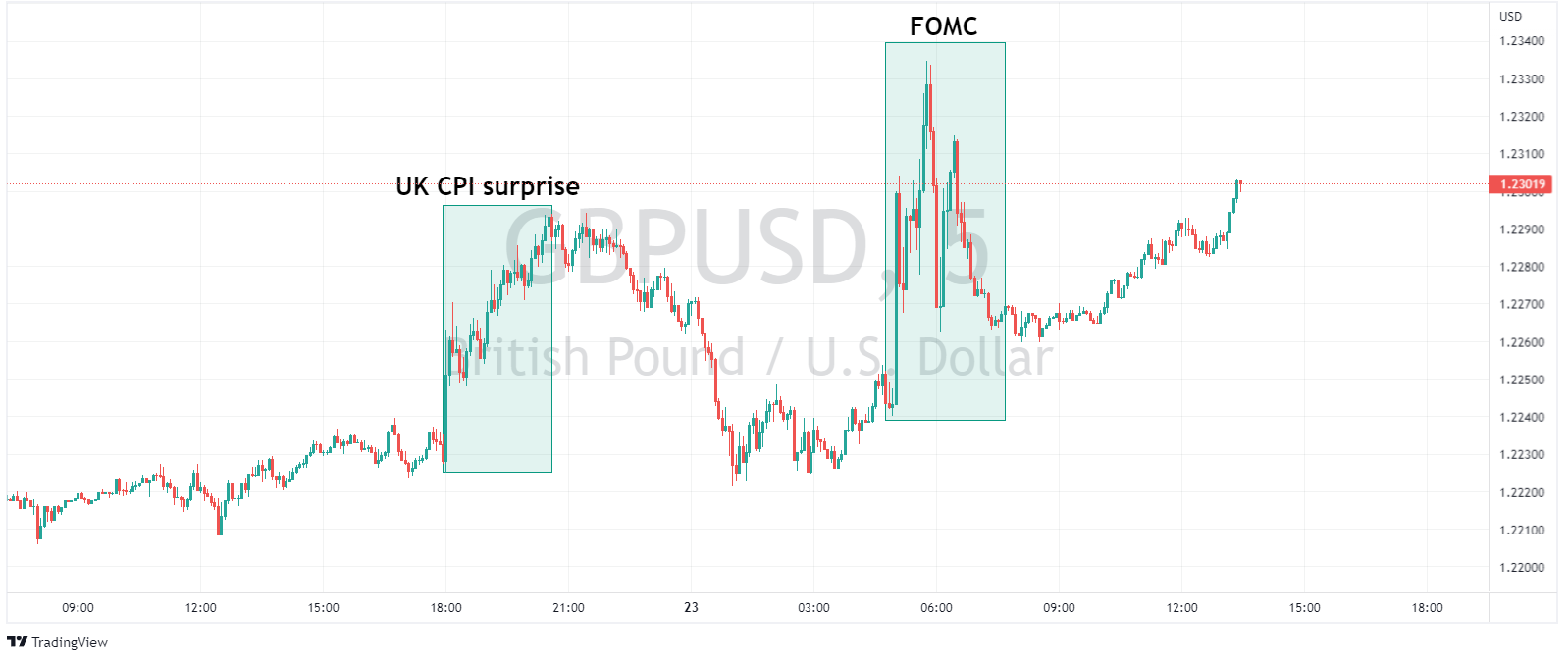

This unsurprisingly saw the GBPUSD rally sharply as the markets repriced the BoE’s actions today, interestingly we can see that the reaction, though a decent move was dwarfed by the volatility seen during and post the FOMC rate decision in this pair. The UK being a world financial hub means the GBP is especially risk sensitive to financial conditions, whether that is global interest rates , banking stress or threats of global growth slowdowns, the actions of the BoE, while still important have taken a seat to these more macro drivers.

With all this in mind the probable 25bp rate hike today will more than likely have a muted first effect on the GBP, the accompanying statement and the voting pattern of the MPC member will be what GBP traders are looking at to get some direction for the session. With the shock of the inflation beat fresh in their minds it’s hard to see the BoE being too dovish but against the current uncertainty in the financial markets I don’t think we’ll see any sustained rally of the GBP after the fact unless there is a real hawkish surprise from the BoE members.

Swiss National Bank

Up until recently the SNB meetings have been almost as boring as the Bank of Japan meetings, this has all changed as BoJ the meetings have thrown up surprises and todays SNB against the backdrop of the collapse of Credit Suisse could actually be interesting.

The markets are pricing in a 50bp hike from the SNB, despite Swiss banking woes it would be a big surprise if they didn’t go through with this, inflation is rising in Switzerland (jumping unexpectedly to 3.4% last month) and they are a long way behind the curve in respects to other Central Banks with their official rate only sitting at 1%, far behind their peers in Europe and the US. Again the interesting part will be the statement and press conference, where the focus will likely remain on interest rate policy and the banking sector. CHF may strengthen on the decision but with major support on the USDCHF around the 0.9094 level, any downside on this pair should be limited.

The SNB decision is due out at 08:30 GMT with the BoE following at 12:00 GMT

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Bollinger Bands – what are they and how can you use them in FX day trading

Bollinger Bands are one of the most popular indicators that FX and CFD traders use, invented in the 1980’s they are a technical analysis tool that are widely used by short and long term traders. The main uses for Bollinger Bands is determining turning points in the market at oversold and overbought levels and also as a trend following indicato...

March 24, 2023Read More >Previous Article

XAUUSD, GBPUSD, and EURUSD Analysis 20 – 24 March 2023

XAUUSD Analysis 20 – 24 March 2023 The outlook for gold prices remains positive in the medium term. This is because gold prices rose above th...

March 22, 2023Read More >