- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- ECB: Draghi’s Last Call for A Significant Degree of Monetary Stimulus

- Home

- News & Analysis

- Central Banks

- ECB: Draghi’s Last Call for A Significant Degree of Monetary Stimulus

- Corporate Sector Purchase Programme (CSPP)

- Public Sector Purchase Programme (PSPP)

- Asset-backed Securities Purchase Programme (ABSPP)

- Third Covered Bond Purchase Programme (CBPP3)

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisECB: Draghi’s Last Call for A Significant Degree of Monetary Stimulus

11 September 2019 By GO MarketsCentral banks of major economies like the US, UK and Japan turned to quantitative easing (QE) at a time where they were unable to push interest rates any lower. The European Central Bank (ECB) launched its first large scale of asset purchases in 2015 and was among the latest central bank to join the QE bandwagon.

How QE works

The ECB adopted the QE program to address the risks of a prolonged period of low inflation and help the Eurozone to return to the desired inflation level.

The QE, also known as the Asset Purchase Program (APP), consists of:

On 13 December 2018, the ECB decided to end the net purchases under the APP and announced that it would keep reinvesting cash from maturing bonds for a long time after its first interest rate hike.

Market Expectations

As the economic sentiment in the eurozone is worsening rapidly, investors are expecting the central bank to announce a robust stimulus package at its next meeting on Thursday:

An Interest Rate Cut and Resuming Quantitative Easing.

However, we saw divergent opinions on whether the central bank should resume asset purchases.

An Interest Rate Cut

An interest rate policy by itself might not be enough, as cutting rates that are already negative will bring little help to the markets. If the central bank resume bond purchases, it could boost monetary and financing conditions. However, we are seeing divergent opinions on whether the central bank should resume asset purchases.

QE2 – The Second Round of Quantitative Easing

In the height of the eurozone crisis from 2011-2014, such policies were probably justified. The current weakness in the euro- area might not be weak enough to warrant such a step, and there is now much skepticism on recommencing such non-standard and controversial monetary policies. The ECB policymakers have also dampened expectations of the resumption of bond purchases lately.

Market participants were initially expecting Mario Draghi to end its term with a significant package of monetary stimulus before Christine Lagarde takes over.

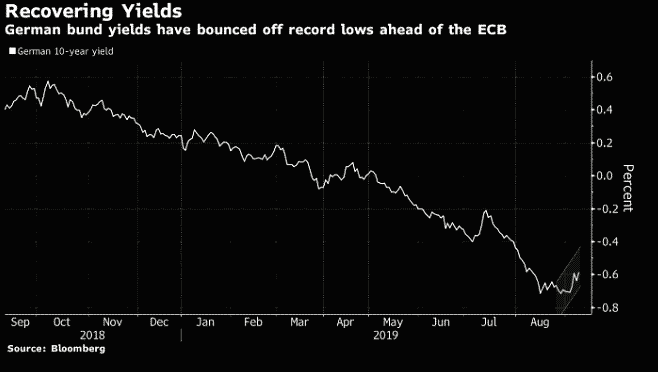

It was are largely priced-in and now that the expectations eased ahead of the meeting, we are seeing European bond yields bouncing off record lows.

Money markets and the foreign exchange markets are still expecting a traditional monetary policy intervention – at least a 10-basis point rate cut. The Euro received a boost on Monday on hopes of German fiscal stimulus, though some expectations of monetary easing have limited the gains.

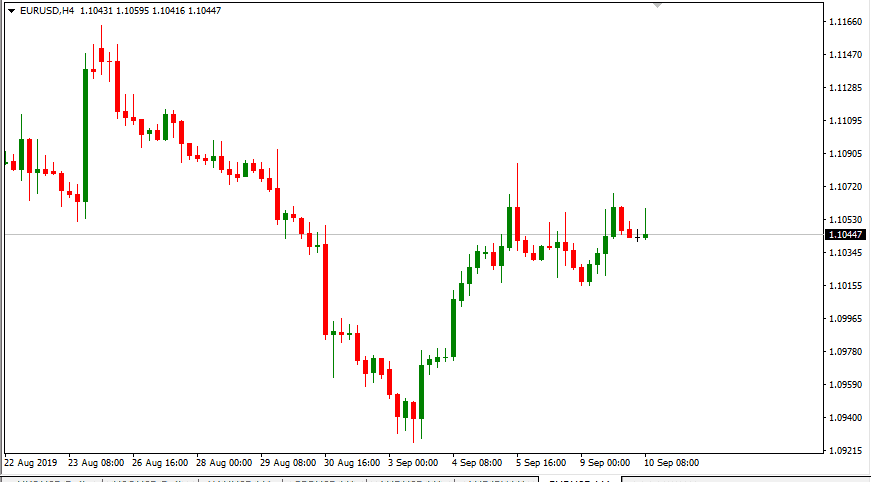

EURUSD (H4 Chart)

Source: GO MT4If the central bank failed to satisfy dovish expectations already instilled in the markets, the shared currency may get a boost. The EURUSD pair may be trading sideways around the 1.10 level ahead of the ECB meeting on Thursday.

The pair could pick up a strong bid if the central bank falls short of expectations.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Margin Call Podcast – S2 E5: Craig Cobb | Managing Director of Trader Cobb

Holding over 11 years of experience as both a trader and educator, Craig has always been the type to distil noise into digestible information. He is one of the most original & astute Australian commentators from the early days of the industry and with that comes a wealth of market experience. Well known for his institutional background, Cra...

September 11, 2019Read More >Previous Article

One Country, Two Systems

One Country, Two Systems The Hong Kong protests have reached a point where it is threatening the “one country, two systems” that exists between ...

September 5, 2019Read More >