- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- Bank of England gives Funds three days to get books in order

- Home

- News & Analysis

- Central Banks

- Bank of England gives Funds three days to get books in order

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe Bank of England has seemingly turned its back on protecting UK Retirement funds, after initially bailing out these funds who were facing serious liquidity issues in relation to their exposure to Fixed income assets.

History

As a part of new UK Prime Minister, Liz Truss’s mini budget she outlined big tax breaks for much of the country. This was to ease the pressure of increasing energy prices and cost of living. Whilst these tax breaks would have been good for the people, increasing flow of money into the economy would not help the Bank of England in its attempt to bring down record high levels of inflation.

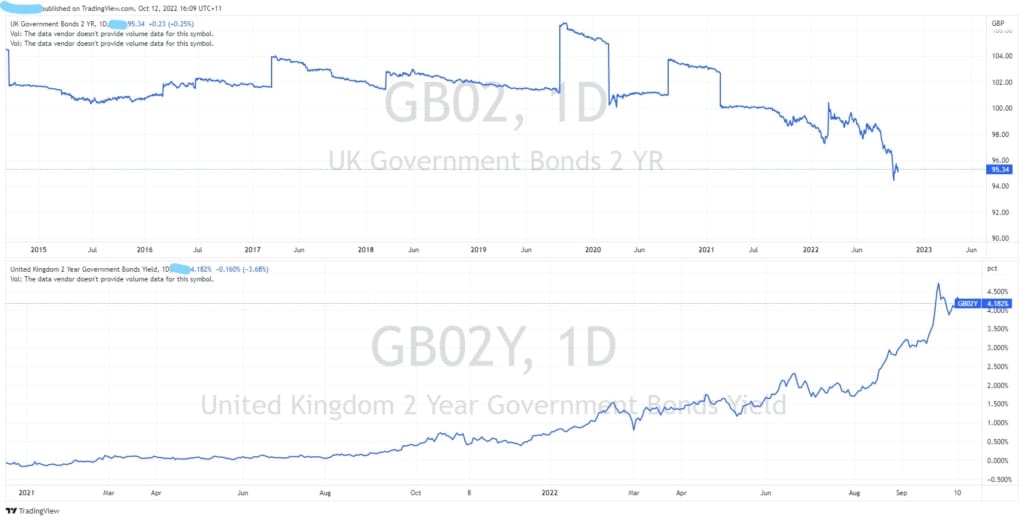

This led to a serious pricing issue for the UK government bonds. As the yields began to rise, the prices began to drop. This caused major issues for many of the country’s retirement funds who held almost 1 trillion pounds of exposure to these bonds and other derivatives.

This created a disastrous situation whereby these funds were having to post more and more collateral and sell off their existing bonds to meet their other obligations. It also caused a viscous cycle of selling and further pushed the prices down with some funds being margin called. With the system on the brink The Bank of England agreed to prop up the market and buy up to 5 billion pounds worth of Bonds per day. This saw an initial spike in bond prices, however it quickly subsided, and the prices have dropped back to prices that they were at before the intervention.

Recent Developments

According to reports, and statements from the Bank of England, the Bank is not as willing to bear the losses of these funds and prop up the market anymore.

Governor, Andrew Baily was not so enthusiastic about more buying stating that they will not bail out the Funds any longer and that they have “3 days” to sort out their books pointing to calmer conditions then the events of prior weeks.

This news may come as a bit of a downer to many who were hoping that intervention would continue to support the UK guilts and the GBP. It may also indicate that the Bank is still primarily focused on getting inflation under control over a potential recession.

The chart below shows the impact of the weakening economy and the currency on the bond market as prices continue to move lower. With volatility set to continue, the question remains, Will there be enough time for the funds to rebalance their books of will the refusal to continue to prop up the bond market come back to bite the United Kingdom’s financial system.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

How to maximise your trading strategy using Relative Volume?

For new traders, it can be difficult to know which indicators to use, the saturation of various moving averages, RSI’s, MACD’s and more can be overwhelming and counterproductive. However, utilising relative volume, as an indicator is one of the most important sources of information for technical traders. What is Volume? Vo...

October 13, 2022Read More >Previous Article

Aussie Dollar breaks through two year price lows

The Aussie dollar has been dropping on the back of global volatility and a lower-than-expected interest rate hike. The AUD has dropped to its two-year...

October 11, 2022Read More >